He Fell Ill on a Cruise. Before He Boarded the Rescue Boat, They Handed Him the Bill.

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Vincent Wasney and his fiancée, Sarah Eberlein, had never visited the ocean. They’d never even been on a plane. But when they bought their first home in Saginaw, Michigan, in 2018, their real estate agent gifted them tickets for a Royal Caribbean cruise.

After two years of delays due to the coronavirus pandemic, they set sail in December 2022.

The couple chose a cruise destined for the Bahamas in part because it included a trip to CocoCay, a private island accessible to Royal Caribbean passengers that featured a water park, balloon rides, and an excursion swimming with pigs.

It was on that day on CocoCay when Wasney, 31, started feeling off, he said.

The next morning, as the couple made plans in their cabin for the last full day of the trip, Wasney made a pained noise. Eberlein saw him having a seizure in bed, with blood coming out of his mouth from biting his tongue. She opened their door to find help and happened upon another guest, who roused his wife, an emergency room physician.

Wasney was able to climb into a wheelchair brought by the ship’s medical crew to take him down to the medical facility, where he was given anticonvulsants and fluids and monitored before being released.

Wasney had had seizures in the past, starting about 10 years ago, but it had been a while since his last one. Imaging back then showed no tumors, and doctors concluded he was likely epileptic, he said. He took medicine initially, but after two years without another seizure, he said, his doctors took him off the medicine to avoid liver damage.

Wasney had a second seizure on the ship a few hours later, back in his cabin. This time he stopped breathing, and Eberlein remembered his lips being so purple, they almost looked black. Again, she ran to find help but, in her haste, locked herself out. By the time the ship’s medical team got into the cabin, Wasney was breathing again but had broken blood vessels along his chest and neck that he later said resembled tiger stripes.

Wasney was in the ship’s medical center when he had a third seizure — a grand mal, which typically causes a loss of consciousness and violent muscle contractions. By then, the ship was close enough to port that Wasney could be evacuated by rescue boat. He was put on a stretcher to be lowered by ropes off the side of the ship, with Eberlein climbing down a rope ladder to join him.

But before they disembarked, the bill came.

The Patient: Vincent Wasney, 31, who was uninsured at the time.

Medical Services: General and enhanced observation, a blood test, anticonvulsant medicine, and a fee for services performed outside the medical facility.

Service Provider: Independence of the Seas Medical Center, the on-ship medical facility on the cruise ship operated by Royal Caribbean International.

Total Bill: $2,500.22.

What Gives: As part of Royal Caribbean’s guest terms, cruise passengers “agree to pay in full” all expenses incurred on board by the end of the cruise, including those related to medical care. In addition, Royal Caribbean does not accept “land-based” health insurance plans.

Wasney said he was surprised to learn that, along with other charges like wireless internet, Royal Caribbean required he pay his medical bills before exiting the ship — even though he was being evacuated urgently.

“Are we being held hostage at this point?” Eberlein remembered asking. “Because, obviously, if he’s had three seizures in 10 hours, it’s an issue.”

Wasney said he has little memory of being on the ship after his first seizure — seizures often leave victims groggy and disoriented for a few hours afterward.

But he certainly remembers being shown a bill, the bulk of which was the $2,500.22 in medical charges, while waiting for the rescue boat.

Still groggy, Wasney recalled saying he couldn’t afford that and a cruise employee responding: “How much can you pay?”

They drained their bank accounts, including money saved for their next house payment, and maxed out Wasney’s credit card but were still about $1,000 short, he said.

Ultimately, they were allowed to leave the ship. He later learned his card was overdrafted to cover the shortfall, he said.

Royal Caribbean International did not respond to multiple inquiries from KFF Health News.

Once on land, in Florida, Wasney was taken by ambulance to the emergency room at Broward Health Medical Center in Fort Lauderdale, where he incurred thousands of dollars more in medical expenses.

He still isn’t entirely sure what caused the seizures.

On the ship he was told it could have been extreme dehydration — and he said he does remember being extra thirsty on CocoCay. He also has mused whether trying escargot for the first time the night before could have played a role. Eberlein’s mother is convinced the episode was connected to swimming with pigs, he said. And not to be discounted, Eberlein accidentally broke a pocket mirror three days before their trip.

Wasney, who works in a stone shop, was uninsured when they set sail. He said that one month before they embarked on their voyage, he finally felt he could afford the health plan offered through his employer and signed up, but the plan didn’t start until January 2023, after their return.

They also lacked travel insurance. As inexperienced travelers, Wasney said, they thought it was for lost luggage and canceled trips, not unexpected medical expenses. And because the cruise was a gift, they were never prompted to buy coverage, which often happens when tickets are purchased.

The Resolution: Wasney said the couple returned to Saginaw with essentially no money in their bank account, several thousand dollars of medical debt, and no idea how they would cover their mortgage payment. Because he was uninsured at the time of the cruise, Wasney did not try to collect reimbursement for the cruise bill from his new health plan when his coverage began weeks later.

The couple set up payment plans to cover the medical bills for Wasney’s care after leaving the ship: one each with two doctors he saw at Broward Health, who billed separately from the hospital, and one with the ambulance company. He also made payments on a bill with Broward Health itself. Those plans do not charge interest.

But Broward Health said Wasney missed two payments to the hospital, and that bill was ultimately sent to collections.

In a statement, Broward Health spokesperson Nina Levine said Wasney’s bill was reduced by 73% because he was uninsured.

“We do everything in our power to provide the best care with the least financial impact, but also cannot stress enough the importance of taking advantage of private and Affordable Care Act health insurance plans, as well as travel insurance, to lower risks associated with unplanned medical issues,” she said.

The couple was able to make their house payment with $2,690 they raised through a GoFundMe campaign that Wasney set up. Wasney said a lot of that help came from family as well as friends he met playing disc golf, a sport he picked up during the pandemic.

“A bunch of people came through for us,” Wasney said, still moved to tears by the generosity. “But there’s still the hospital bill.”

The Takeaway: Billing practices differ by cruise line, but Joe Scott, chair of the cruise ship medicine section of the American College of Emergency Physicians, said medical charges are typically added to a cruise passenger’s onboard account, which must be paid before leaving the ship. Individuals can then submit receipts to their insurers for possible reimbursement.

More from Bill of the Month

- Sign Here? Financial Agreements May Leave Doctors in the Driver’s Seat Apr 30, 2024

- A Mom’s $97,000 Question: How Was Her Baby’s Air-Ambulance Ride Not Medically Necessary? Mar 25, 2024

- Without Medicare Part B’s Shield, Patient’s Family Owes $81,000 for a Single Air-Ambulance Flight Feb 27, 2024

He recommended that those planning to take a cruise purchase travel insurance that specifically covers their trips. “This will facilitate reimbursement if they do incur charges and potentially cover a costly medical evacuation if needed,” Scott said.

Royal Caribbean suggests that passengers who receive onboard care submit their paid bills to their health insurer for possible reimbursement. Many health plans do not cover medical services received on cruise ships, however. Medicare will sometimes cover medically necessary health care services on cruise ships, but not if the ship is more than six hours away from a U.S. port.

Travel insurance can be designed to address lots of out-of-town mishaps, like lost baggage or even transportation and lodging for a loved one to visit if a traveler is hospitalized.

Travel medical insurance, as well as plans that offer “emergency evacuation and repatriation,” are two types that can specifically assist with medical emergencies. Such plans can be purchased individually. Credit cards may offer travel medical insurance among their benefits, as well.

But travel insurance plans come with limitations. For instance, they may not cover care associated with preexisting conditions or what the plans consider “risky” activities, such as rock climbing. Some plans also require that travelers file first with their primary health insurance before seeking reimbursement from travel insurance.

As with other insurance, be sure to read the fine print and understand how reimbursement works.

Wasney said that’s what they plan to do before their next Royal Caribbean cruise. They’d like to go back to the Bahamas on basically the same trip, he said — there’s a lot about CocoCay they didn’t get to explore.

Bill of the Month is a crowdsourced investigation by KFF Health News and NPR that dissects and explains medical bills. Do you have an interesting medical bill you want to share with us? Tell us about it!

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Recommended

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Ozempic vs Five Natural Supplements

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Semaglutide (GLP-1 agonist) drugs Ozempic and Wegovy really do work for losing weight, provided one then remains on these expensive drugs for life. Dr. Jin Sung recommends a supplements-based approach, instead.

Natural Alternatives

Dr. Sung recommends:

- Berberine, which increases production and secretion of GLP-1.

- Probiotics, which increase GLP-1 secretion. In particular he recommends Akkermansia municiphila which secretes P9, and this protein stimulates GLP-1 production and secretion.

- Psyllium, a soluble dietary fiber which will increase short-chain fatty acids which then help with increasing GLP-1.

- Curcumin, which enhances L-cell numbers, in turn promoting and increasing GLP-1 secretion. Also, curcumin may prolong gastric emptying, and increase insulin sensitivity.

- Ginseng, of which the bioactive compound stimulates secretion of GLP-1, and also has anti-diabetic effects.

Dr. Sung explains more about each of these in his video:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to know more?

You might enjoy our previous main feature looking at some of the pros and cons:

Take care!

Share This Post

-

5 Steps To Quit Sugar Easily

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Sugar is one of the least healthy things that most people consume, yet because it’s so prevalent, it can also be tricky to avoid at first, and the cravings can also be a challenge. So, how to quit it?

Step by step

Dr. Mike Hansen recommends the following steps:

- Be aware: a lot of sugar consumption is without realizing it or thinking about it, because of how common it is for there to be added sugar in things we might purchase ready-made, even supposedly healthy things like yogurts, or easy-to-disregard things like condiments.

- Recognize sugar addiction: a controversial topic, but Dr. Hansen comes down squarely on the side of “yes, it’s an addiction”. He wants us to understand more about the mechanics of how this happens, and what it does to us.

- Reduce gradually: instead of going “cold turkey”, he recommends we avoid withdrawal symptoms by first cutting back on liquid sugars like sodas, juices, and syrups, before eliminating solid sugar-heavy things like candy, sugar cookies, etc, and finally the more insidious “why did they put sugar in this?” added-sugar products.

- Find healthy alternatives: simple like-for-like substitutions; whole fruits instead of juices/smoothies, for example. 10almonds tip: stuffing dates with an almond each makes it very much like eating chocolate, experientially!

- Manage cravings: Dr. Hansen recommends distraction, and focusing on upping other healthy habits such as hydration, exercise, and getting more vegetables.

For more on each of these, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like to read:

- Which Sugars Are Healthier, And Which Are Just The Same?

- Mythbusting The Not-So-Sweet Science Of Sugar Addiction

Take care!

Share This Post

-

Are Waist Trainers Just A Waste, And Are Posture Fixers A Quick Fix?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Are Waist Trainers Just A Waste, And Are Posture Fixers A Quick Fix?

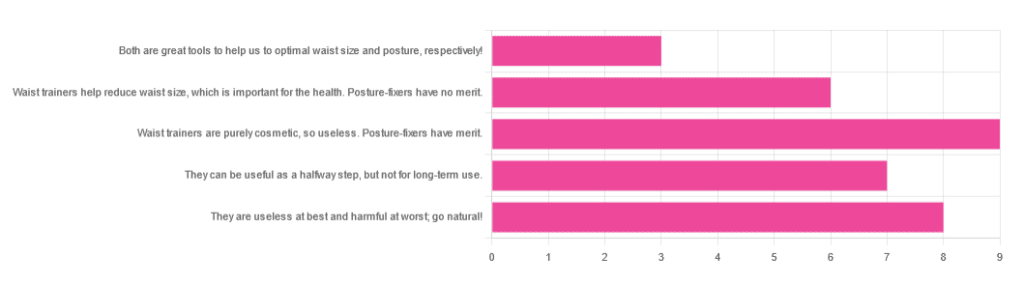

Yesterday, we asked you for your opinions on waist trainers and posture-fixing harnesses, and got the above-depicted, below-described set of results:

- The most popular response was “Waist trainers are purely cosmetic, so useless. Posture-fixers have merit”, with a little over a quarter of the votes.

- The least popular response was “Both are great tools to help us to optimal waist size and posture, respectively!”

- The other three answers each got a little under a quarter of the vote. In terms of discrete data, these were all 7±1, so basically, there was nothing in it.

The sample size was smaller than usual—perhaps the cluster of American holiday dates yesterday and today kept people busy! But, pressing on…

What does the science say?

Waist trainers are purely cosmetic, so, useless. True or False?

True, simply. Honestly, they’re not even that great for cosmetic purposes. They will indeed cinch in your middle, and this shape will be retained for a (very) short while after uncinching, because your organs have been squished inwards and may take a short while to get back to where they are supposed to be.

The American Board of Cosmetic Surgery may not be an unbiased source, but we’re struggling to find scientists who will even touch one of these, so, let’s see what these doctors have to say:

- Waist training can damage vital organs

- You will be slowly suffocating yourself

- Waist training simply doesn’t work

- You cannot drastically change your body shape with a piece of fabric*

Read: ABCS | 4 Reasons to Throw Your Waist Trainer in the Trash

*”But what about foot-binding?”—feet have many bones, whose growth can be physically restricted. Your waist has:

- organs: necessary! (long-term damage possible, but they’re not going away)

- muscles: slightly restrictable! (temporary restriction; no permanent change)

- fat: very squeezable! (temporary muffin; no permanent change)

Posture correctors have merit: True or False?

True—probably, and as a stepping-stone measure only.

The Ergonomics Health Association (a workplace health & safety organization) says:

❝Looking at the clinical evidence of posture correctors, we can say without a doubt that they do work, just not for everyone and not in the same way for all patients.❞

Source: Do Posture Correctors Work? Here’s What Our Experts Think

That’s not very compelling, so we looked for studies, and found… Not much, actually. However, what we did find supported the idea that “they probably do help, but we seriously need better studies with less bias”:

That is also not a compelling title, but here is where it pays to look at the studies and not just the titles. Basically, they found that the results were favorable to the posture-correctors—the science itself was just trash:

❝ The overall findings were that posture-correcting shirts change posture and subjectively have a positive effect on discomfort, energy levels and productivity.

The quality of the included literature was poor to fair with only one study being of good quality. The risk of bias was serious or critical for the included studies. Overall, this resulted in very low confidence in available evidence.❞

Since the benefit of posture correctors like this one is due to reminding the wearer to keep good posture, there is a lot more (good quality!) science for wearable biofeedback tech devices, such as this one:

Spine Cop: Posture Correction Monitor and Assistant

Take care!

Share This Post

Related Posts

-

Your Health Audit, From Head To Toe

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Health Audit Time

Here at 10almonds, we often cover quite specific things, ranging from “the effect of sodium on organs other than your heart” to “make this one small change to save your knees while driving”.

But, we’re each a whole person, and we need to take care of the whole organism that makes up the wonderful being that we each are. If we let one part of it drop in health too much, the others will soon follow suit because of the knock-on effects.

So, let’s do a quick self-check-up, and see what can be done for each! How’s your…

Mental Health

We’re doing this audit head-to-to, so let’s start it here, because mental health is also just health, and it’s difficult to tackle the others without having this one at least under control!

Are you experiencing chronic stress? Anxiety? Depression? Joy?

If you answered “no” to “joy” but also “no” to “depression”, you might want to rethink your answer to “depression”, by the way. Life should be a joyous thing!

Some resources to address your mental health:

Brain Health

Your brain is a big, powerful organ. It uses more of your daily energy (in the physiological sense of the word, we’re talking calories and mitochondria and ATP) than any other organ, by far.

And when it comes to organ failure, if your brain fails, then having the best joints in the world won’t help you, for example.

Some resources to address your brain health:

- Brain Food? The Eyes Have It

- How To Reduce Your Alzheimer’s Risk

- The 6 Dimensions Of Sleep (And Why They Matter)

Heart Health

Everything depends on your heart, head to toe. Tirelessly pumping blood with oxygen, nutrients, and agents of your immune system all around your body, all day every day for your entire life.

What’s your resting heart rate like? How about your blood pressure? And while we’re on the topic of blood… how’s your blood sugar health?

These are all important things to a) know about and b) keep on top of!

Some resources to address your heart health:

- 1-Minute Heart Health Check-Up Tips

- A Five-Point Plan For Heart Health

- High Blood Pressure? Try These!

Gut Health

By cell count, we’re about 10% human and 90% bacteria. By gene count, also. Pretty important, therefore, that we look after our trillions of tiny friends that keep our organism working.

Most people in N. America, for example, get vastly under the recommended daily amount of fiber, and that’s just the most basic courtesy we could do for these bugs that keep us alive (they need that fiber to live, and their process of consuming it is beneficial to us in a stack of ways).

Some resources to address your gut health:

- Making Friends With Your Gut (You Can Thank Us Later)

- The Surprising Link Between Gut Health And Serotonin

- The Vagus Nerve: The Brain-Gut Highway!

Hormonal Health

Hormones are weird and wonderful and affect so much more than the obvious sex-related functions (but yes, those too). A lot of people don’t realize it, but having our hormones in good order or not can make the difference between abject misery and a happy, fulfilling life.

Some resources to address your hormonal health:

- What Does “Balance Your Hormones” Even Mean?

- Healthy Hormones And How To Hack Them

- Too Much Or Too Little Testosterone?

Bone/Joint Health

Fear nothing! For you are a ghost operating a skeleton clad in flesh. But also, you know, look after that skeleton; you only get one! Being animals, we’re all about movement, and being humans, we’ve ended up with some lifestyle situations that aren’t great for that mobility. We sit too much; we walk too little; we cramp ourselves into weird positions (driving, anyone?), and we forget the range of motion we’re supposed to have. But let’s remember…

Some resources to address your bone/joint health:

- Collagen’s benefits are more than skin deep

- Cool As A Cucumber (Move Over, Glucosamine + Chondroitin)

- 5 Best Bodyweight Exercises For Incredible Mobility

Lastly…

While it’s good to do a little self-audit like this every now and again, it’s even better to get a professional check-up!

As engineers say: if you don’t schedule time for maintenance, your equipment will schedule it for you.

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

The S.T.E.P.S. To A Healthier Heart

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Stepping Into Better Heart Health

This is Dr. Jennifer H. Mieres, FACC, FAHA, MASNC. she’s an award-winning (we counted 9 major awards) professor of cardiology, and a leading advocate for women’s heart health. This latter she’s done via >70 scientific publications, >100 research presentations at national and international conferences, 3 books so far, and 4 documentaries, including the Emmy-nominated “A Woman’s Heart”.

What does she want us to know?

A lot of her work is a top-down approach, working to revolutionize the field of cardiology in its application, to result in far fewer deaths annually. Which is fascinating, but unless you’re well-placed in that industry, not something too actionable as an individual (if you are well-placed in that industry, do look her up, of course).

For the rest of us…

Dr. Mieres’ S.T.E.P.S. to good heart health

She wants us to do the following things:

1) Stock your kitchen with heart health in mind

This is tied to the third item in the list of course, but it’s a critical step not to be overlooked. It’s all very well to know “eat more fiber; eat less red meat” and so forth, but if you go to your kitchen and what’s there is not conducive to heart health, you’re just going to do the best with what’s available.

Instead, actually buy foods that are high in fiber, and preferably, foods that you like. Not a fan of beans? Don’t buy them. Love pasta? Go wholegrain. Like leafy greens in principle, but they don’t go with what you cook? Look up some recipes, and then buy them.

Love a beef steak? Well we won’t lie to you, that is not good for your heart, but make it a rare option—so to speak—and enjoy it mindfully (see also: mindful eating) once in a blue moon for a special occasion, rather than “I don’t know what to cook tonight, so sizzle sizzle I guess”.

Meal planning goes a long way for this one! And if meal-planning sounds like an overwhelming project to take on, then consider trying one of the many healthy-eating meal kit services that will deliver ingredients (and their recipes) to your door—opting for a plants-forward plan, and the rest should fall into place.

2) Take control of your activity

Choose to move! Rather than focusing on what you can’t do (let’s say, those 5am runs, or your regularly-scheduled, irregularly attended, gym sessions), focus on what you can do, and do it.

See also: No-Exercise Exercise!

3) Eat for a healthier heart

This means following through on what you did on the first step, and keeping it that way. Buying fresh fruit and veg is great, but you also have to actually eat it. Do not let the perishables perish!

For you too, dear reader, are perishable (and would presumably like to avoid perishing).

This item in the list may seem flippant, but actually this is about habit-forming, and without it, the whole plan will grind to a halt a few days after your first heart-health-focused shopping trip.

See also: Where Nutrition Meets Habits!

4) Partner with your doctor, family, and friends

Good relationships, both professional and personal, count for a lot. Draw up a plan with your doctor; don’t just guess at when to get this or that checked—or what to do about it if the numbers aren’t to your liking.

Partnership with your doctor goes both ways, incidentally. Read up, have opinions, discuss them! Doing so will ultimately result in better care than just going in blind and coming out with a recommendation you don’t understand and just trust (but soon forget, because you didn’t understand).

And as for family and friends, this is partly about social factors—we tend to influence, and be influenced by, those around us. It can be tricky to be on a health kick if your partner wants take-out every night, so some manner of getting everyone on the same page is important, be it by compromise or, in an ideal world, gradually trending towards better health. But any such changes must come from a place of genuine understanding and volition, otherwise at best they won’t stick, and at worst they’ll actively create a pushback.

Same goes for exercise as for diet—exercising together is a good way to boost commitment, especially if it’s something fun (dance classes are a fine example that many couples enjoy, for example).

5) Sleep more, stress less, savor life

These things matter a lot! Many people focus on cutting down salt or saturated fat, and that can be good if otherwise consumed to excess, but for most people they’re not the most decisive factors:

Hypertension: Factors Far More Relevant Than Salt ← sleep features here!

Stress is also a huge one, and let’s put it this way: people more often have heart attacks during a moment of excessive emotional stress—not during a moment when they had a bit too much butter on their toast.

It’s not even just that acute stress is the trigger, it’s that chronic stress is a contributory factor that erodes the body’s ability to handle the acute stress.

Changing this may seem “easier said than done” because often the stressors are external (e.g. work pressure, financial worries, caring for a sick relative, relationship troubles, major life change, etc), but it is possible to find peace even in the chaos of life:

Want to know more from Dr. Mieres?

You might like this book of hers, which goes into each of the above items in much more depth than we have room to here:

Heart Smarter for Women: Six Weeks to a Healthier Heart – by Dr. Jennifer Mieres

Enjoy!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

What is AuDHD? 5 important things to know when someone has both autism and ADHD

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

You may have seen some new ways to describe when someone is autistic and also has attention-deficit hyperactivity disorder (ADHD). The terms “AuDHD” or sometimes “AutiADHD” are being used on social media, with people describing what they experience or have seen as clinicians.

It might seem surprising these two conditions can co-occur, as some traits appear to be almost opposite. For example, autistic folks usually have fixed routines and prefer things to stay the same, whereas people with ADHD usually get bored with routines and like spontaneity and novelty.

But these two conditions frequently overlap and the combination of diagnoses can result in some unique needs. Here are five important things to know about AuDHD.

Kosro/Shutterstock 1. Having both wasn’t possible a decade ago

Only in the past decade have autism and ADHD been able to be diagnosed together. Until 2013, the Diagnostic and Statistical Manual of Mental Disorders (DSM) – the reference used by health workers around the world for definitions of psychological diagnoses – did not allow for ADHD to be diagnosed in an autistic person.

The manual’s fifth edition was the first to allow for both diagnoses in the same person. So, folks diagnosed and treated prior to 2013, as well as much of the research, usually did not consider AuDHD. Instead, children and adults may have been “assigned” to whichever condition seemed most prominent or to be having the greater impact on everyday life.

2. AuDHD is more common than you might think

Around 1% to 4% of the population are autistic.

They can find it difficult to navigate social situations and relationships, prefer consistent routines, find changes overwhelming and repetition soothing. They may have particular sensory sensitivities.

ADHD occurs in around 5–8% of children and adolescents and 2–6% of adults. Characteristics can include difficulties with focusing attention in a flexible way, resulting in procrastination, distraction and disorganisation. People with ADHD can have high levels of activity and impulsivity.

Studies suggest around 40% of those with ADHD also meet diagnostic criteria for autism and vice versa. The co-occurrence of having features or traits of one condition (but not meeting the full diagnostic criteria) when you have the other, is even more common and may be closer to around 80%. So a substantial proportion of those with autism or ADHD who don’t meet full criteria for the other condition, will likely have some traits.

3. Opposing traits can be distressing

Autistic people generally prefer order, while ADHDers often struggle to keep things organised. Autistic people usually prefer to do one thing at a time; people with ADHD are often multitasking and have many things on the go. When someone has both conditions, the conflicting traits can result in an internal struggle.

For example, it can be upsetting when you need your things organised in a particular way but ADHD traits result in difficulty consistently doing this. There can be periods of being organised (when autistic traits lead) followed by periods of disorganisation (when ADHD traits dominate) and feelings of distress at not being able to maintain organisation.

There can be eventual boredom with the same routines or activities, but upset and anxiety when attempting to transition to something new.

Autistic special interests (which are often all-consuming, longstanding and prioritised over social contact), may not last as long in AuDHD, or be more like those seen in ADHD (an intense deep dive into a new interest that can quickly burn out).

Autism can result in quickly being overstimulated by sensory input from the environment such as noises, lighting and smells. ADHD is linked with an understimulated brain, where intense pressure, novelty and excitement can be needed to function optimally.

For some people the conflicting traits may result in a balance where people can find a middle ground (for example, their house appears tidy but the cupboards are a little bit messy).

There isn’t much research yet into the lived experience of this “trait conflict” in AuDHD, but there are clinical observations.

4. Mental health and other difficulties are more frequent

Our research on mental health in children with autism, ADHD or AuDHD shows children with AuDHD have higher levels of mental health difficulites than autism or ADHD alone.

This is a consistent finding with studies showing higher mental health difficulties such as depression and anxiety in AuDHD. There are also more difficulties with day-to-day functioning in AuDHD than either condition alone.

So there is an additive effect in AuDHD of having the executive foundation difficulties found in both autism and ADHD. These difficulties relate to how we plan and organise, pay attention and control impulses. When we struggle with these it can greatly impact daily life.

5. Getting the right treatment is important

ADHD medication treatments are evidence-based and effective. Studies suggest medication treatment for ADHD in autistic people similarly helps improve ADHD symptoms. But ADHD medications won’t reduce autistic traits and other support may be needed.

Non-pharmacological treatments such as psychological or occupational therapy are less researched in AuDHD but likely to be helpful. Evidence-based treatments include psychoeducation and psychological therapy. This might include understanding one’s strengths, how traits can impact the person, and learning what support and adjustments are needed to help them function at their best. Parents and carers also need support.

The combination and order of support will likely depend on the person’s current functioning and particular needs. https://www.youtube.com/embed/pMx1DnSn-eg?wmode=transparent&start=0 ‘Up until recently … if you had one, you couldn’t have the other.’

Do you relate?

Studies suggest people may still not be identified with both conditions when they co-occur. A person in that situation might feel misunderstood or that they can’t fully relate to others with a singular autism and ADHD diagnosis and something else is going on for them.

It is important if you have autism or ADHD that the other is considered, so the right support can be provided.

If only one piece of the puzzle is known, the person will likely have unexplained difficulties despite treatment. If you have autism or ADHD and are unsure if you might have AuDHD consider discussing this with your health professional.

Tamara May, Psychologist and Research Associate in the Department of Paediatrics, Monash University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails: