Most People Try The Wrong Way To Unshrimp Their Posture (Here’s How To Do It Better)

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Many people try to correct posture by pulling the shoulders back and tucking in the chin, but that doesn’t work. Happily, there is a way that does! Kinesiologist Kyle Waugh demonstrates:

Defying gravity

The trick is simple, and is about how maintaining good posture needs to be unconscious and natural, not forced. After all, who is maintaining singular focus for 16 waking hours a day?

Instead, pay attention to how the body relates to gravity without excessive muscle tension, aligning the (oft-forgotten!) hips, and maintaining balance. The importance of hip position is really not to be underestimated, since in many ways the hips are a central axis of the body just as the spine is, and the spine itself sits in the hips.

A lot of what holds the body in poor posture tends to be localized muscle tensions, so address those with stretches and relaxation exercises.

For a few quick tests and exercises to try, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like to read:

6 Ways To Look After Your Back ← no video on this one, just 6 concepts that you can apply to your daily life

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Recommended

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

15 Easy Japanese Habits That Will Transform Your Health

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

The original title says “no-cost habits”, but in fairness, for most of us food is not usually free (alas). So, we will say “easy” instead, because they are indeed easy to build into your life:

15 Healthy Habits To Adopt

We’ll not keep them a mystery; they are:

- Intermittent fasting: naturally fasting for at least 12 hours overnight improves digestion and sleep quality.

- Fermented foods: regularly consuming fermented foods (like kimchi, or even just sauces like miso and shio koji) supports gut health.

- Rice & legumes over wheat: choosing wholegrain rice as a staple reduces bloating and benefits skin health (lentils are even better).

- Big breakfast, light dinner: eating a heavier breakfast and a lighter dinner gives energy in the morning and allows digestion to rest at night.

- Balancing indulgences: enjoying social meals without guilt and balancing food intake the next day.

- Daily gentle exercise: doing at least 15 minutes of yoga, Pilates, or light walking for long-term health.

- Daily baths: taking a warm bath boosts blood circulation and relaxation.

- Eating seasonal & diverse foods: including a variety of fresh, seasonal ingredients for balanced nutrition.

- Consistent morning routine: waking up at the same time, cleansing and moisturizing, and having a proper breakfast.

- Enjoying soup with meals: consuming nutrient-rich soups with vegetables and protein to prevent overeating.

- Chewing food thoroughly: eating slowly and chewing well aids digestion and enhances enjoyment.

- Light seasoning in food: avoiding overly salty or flavorful meals to appreciate natural tastes.

- Maintaining good posture: paying attention to posture during daily activities for better overall health.

- Prioritizing protein intake: eating protein-rich foods like tofu, beans, eggs, and fish, to maintain skin firmness as well as muscletone.

- Confidence in aging: focusing on internal well-being over external opinions and embracing health at every age.

For more on each of these, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like:

Take care!

Share This Post

-

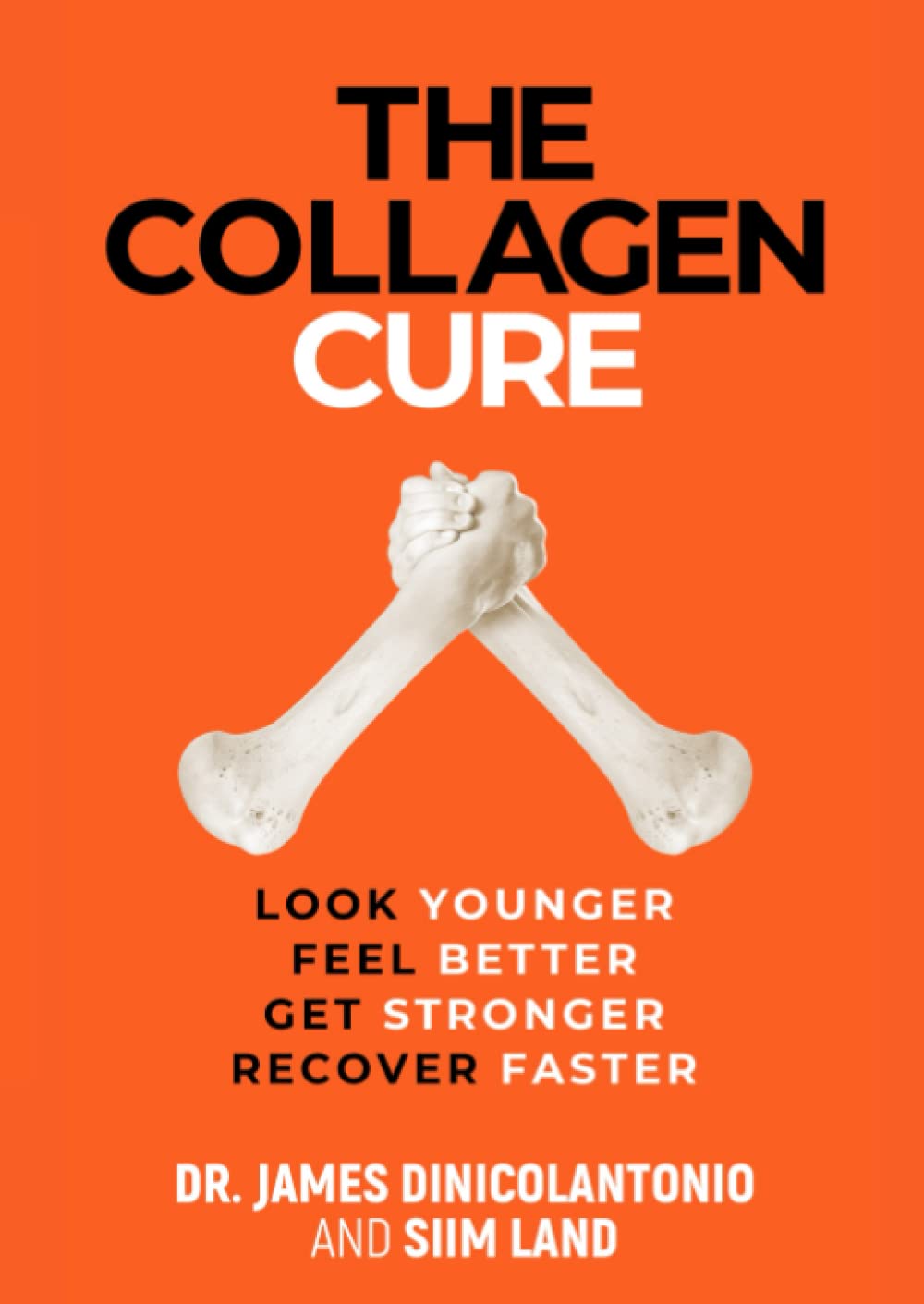

The Collagen Cure – by Dr. James DiNicolantonio

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Collagen is vital for, well, most of our bodies, really. Where me most tend to feel its deficiency is in our joints and skin, but it’s critical for bones and many other tissues too.

You may be wondering: why a 572-page book to say what surely must amount to “take collagen, duh”?

Dr. DiNicolantonio has a lot more of value to offer us than that. In this book, we learn about not just collagen synthesis and usage, different types of collagen, the metabolism of it in our diet (if we get it—vegans and vegetarians won’t). We also learn about the building blocks of collagen (vegans and vegetarians do get these, assuming a healthy balanced diet), with a special focus on glycine, the smallest amino acid which makes up about a third of the mass of collagen (a protein).

Not stopping there, we also learn about the interplay of other nutrients with our metabolism of glycine and, if applicable, collagen. Vitamin C and copper are star features, but there’s a lot more going on with other nutrients too, down to the level of “So take this 75 minutes before this but after that and/but definitely not with the other”, etc.

The style is incredibly clear and readable for something that’s also quite scientifically dense (over 1000 references and many diagrams).

Bottom line: if you’re serious about maintaining your body as you get older, and you’d like a book about collagen that’s a lot more helpful than “take collagen, duh”, then this is the book for you.

Click here to check out The Collagen Cure, and take care of yours!

Share This Post

-

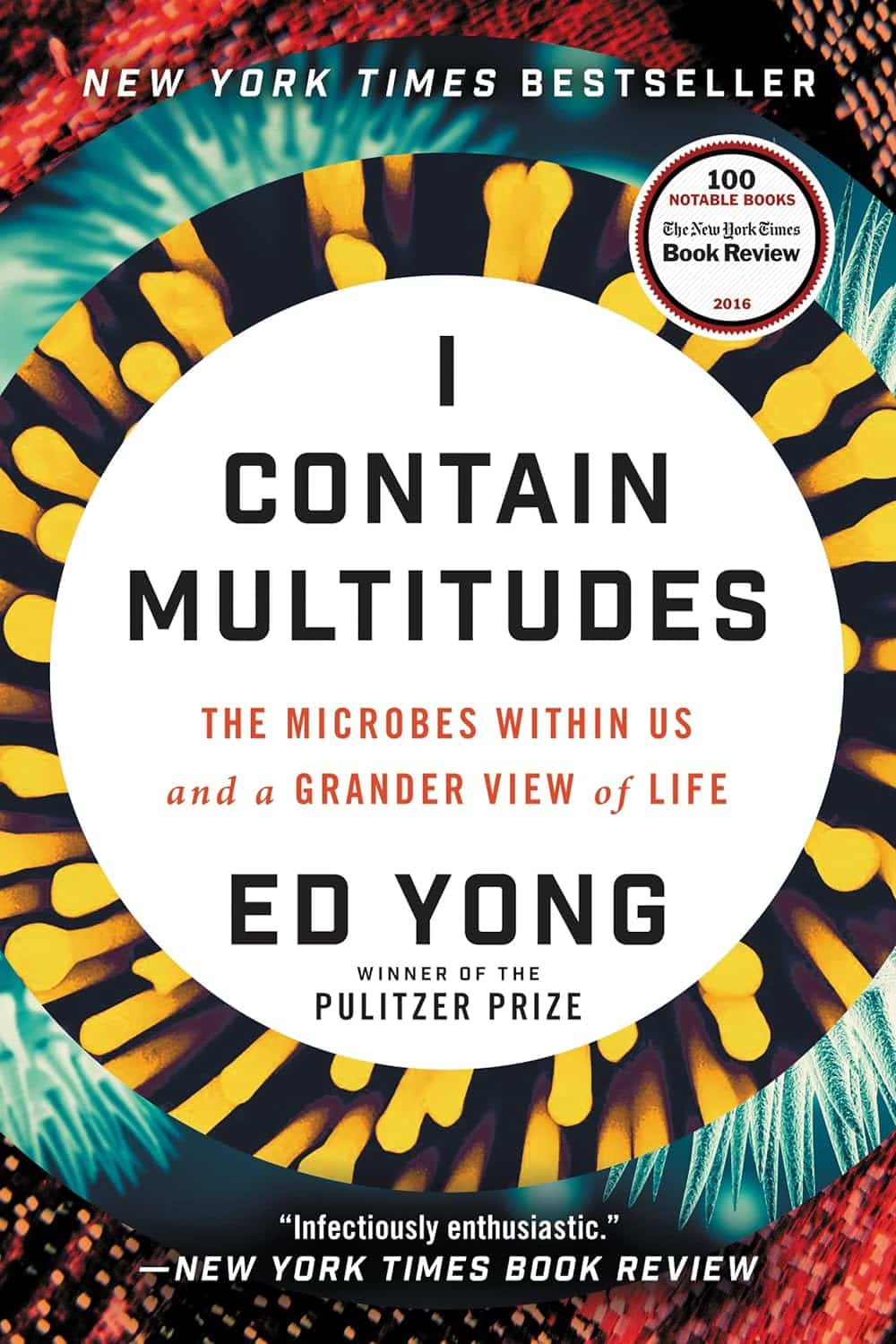

I Contain Multitudes – by Ed Yong

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

A little while back we reviewed a book (Planet of Viruses) about the role of viruses in our lives, beyond the obvious. Today’s book gives the same treatment to microbes in general—mostly bacteria.

We all know about pathogens, and we all know about gut microbiota and that some (hopefully the majority) there are good for our health. This book covers those things too, but also much more.

Pulitzer Prize-winning science writer Ed Yong takes a big picture view (albeit, of some very small things) and looks at the many ways microbes keep us alive, directly or indirectly. From the microbes that convert certain proteins in breast milk into a form that babies can digest (yes, this means we produce nutrients in breast milk that have been evolved solely to feed that bacterium), to those without which agriculture would simply not work, we’re brought to realize how much our continued existence is contingent on our trillions of tiny friends.

The style throughout is easy-reading pop-science, very accessible. There’s also plenty in terms of practical take-away value, when it comes to adjusting our modern lives to better optimize the benefits we get from microbes—inside and out.

Bottom line: if you’d like to learn about the role of microbes in our life beyond “these ones are pathogens” and “these ones help our digestion”, this is the book for you.

Click here to check out I Contain Multitudes, and learn more about yours and those around you!

Share This Post

Related Posts

-

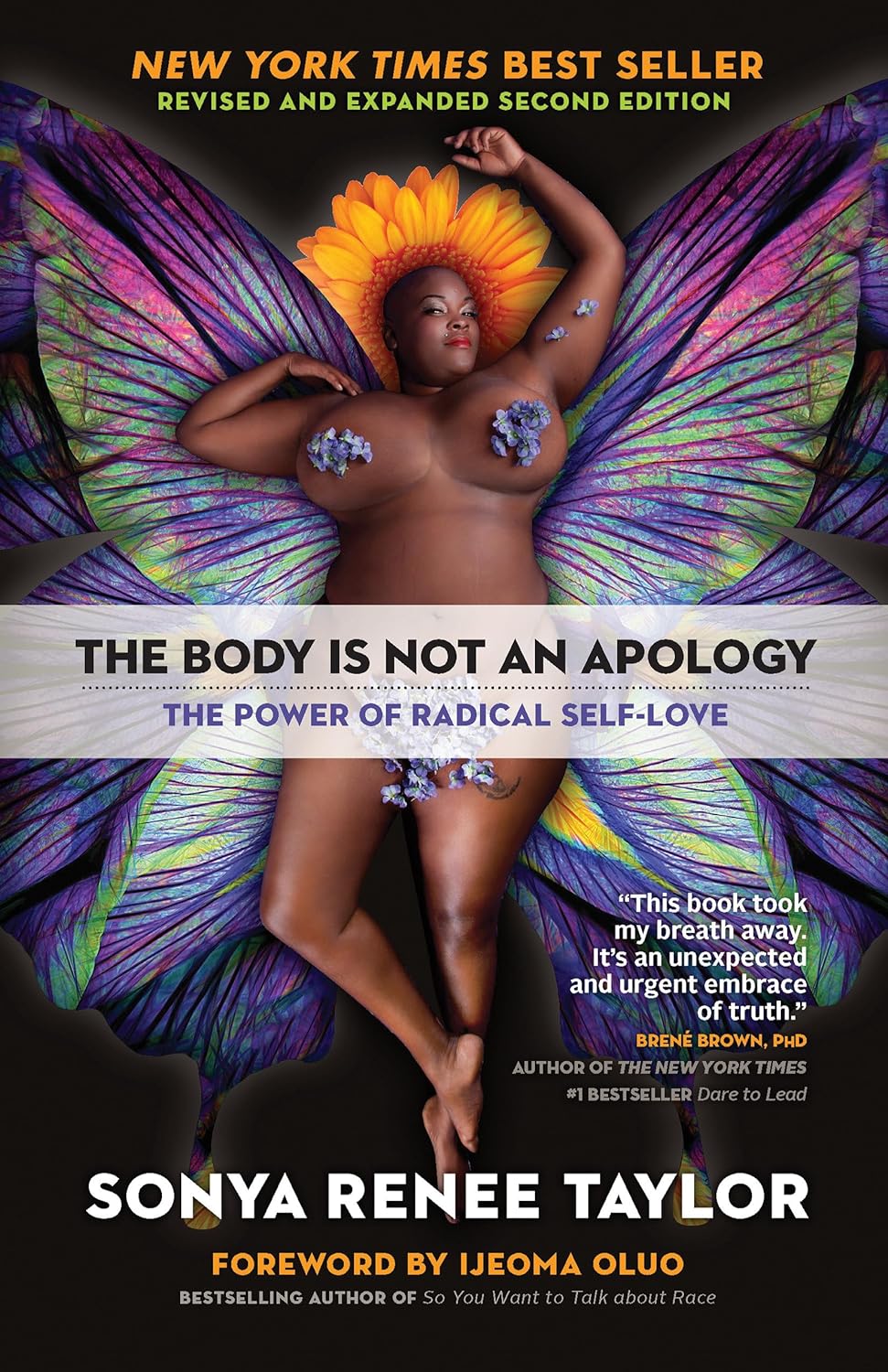

The Body Is Not an Apology – by Sonya Renee Taylor

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

First, a couple of things that this book is not about:

- Self-confidence (it’s about more than merely thinking highly of oneself)

- Self-acceptance (it’s about more than merely settling for “good enough”)

In contrast, it’s about loving and celebrating what is, while striving for better, for oneself and for others.

You may be wondering: whence this “radical” in the title?

The author argues that often, the problem with our bodies is not actually our bodies. If we have cancer, or diabetes, then sure, that’s a problem with the body. But most of the time, the “problem with our bodies” is simply society’s rejection of our “imperfect” bodies as somehow “less than”, and something we must invest time and money to correct. Hence, the need for a radical uprooting of ideas, to fix the real problem.

Bottom line: if, like most of us, you have a body that would not entirely pass for that of a Marvel Comics superhero, this is a book for you. And if you do have a MCU body? This is also a book for you, because we have bad news for you about what happens with age.

Click here to check out The Body Is Not An Apology, and appreciate more about yours!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Millet vs Buckwheat – Which is Healthier?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Our Verdict

When comparing millet to buckwheat, we picked the buckwheat.

Why?

Both of these naturally gluten-free grains* have their merits, but we say buckwheat comes out on top for most people (we’ll discuss the exception later).

*actually buckwheat is a flowering pseudocereal, but in culinary terms, we’ll call it a grain, much like we call tomato a vegetable.

Considering the macros first of all, millet has slightly more carbs while buckwheat has more than 2x the fiber. An easy win for buckwheat (they’re about equal on protein, by the way).

In the category of vitamins, millet has more of vitamins B1, B2, B3, B6, and B9, while buckwheat has more of vitamins B5, E, K, and choline. Superficially that’s a 5:4 win for millet, though buckwheat’s margins of difference are notably greater, so the overall vitamin coverage could arguably be considered a tie.

When it comes to minerals, millet has more phosphorus and zinc, while buckwheat has more calcium, copper, iron, magnesium, manganese, potassium, and selenium. For most of them, buckwheat’s margins of difference are again greater. An easy win for buckwheat, in any case.

This all adds up to a clear win for buckwheat, but as promised, there is an exception: if you have issues with your kidneys that mean you are avoiding oxalates, then millet becomes the healthier choice, as buckwheat is rather high in oxalates while millet is low in same.

For everyone else: enjoy both! Diversity is good. But if you’re going to pick one, buckwheat’s the winner.

Want to learn more?

You might like to read:

Grains: Bread Of Life, Or Cereal Killer?

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Does Your Butt…Wink?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

What is a Butt Wink?

A “butt wink” is a common issue that occurs during squatting exercises.

Now, we’ve talked about the benefits of squatting countless times (see here or here for just a few examples). As with all exercises, using the correct technique is imperative, helping to both reduce injury and maximize gain.

Given butt winks are a common issue when squatting, we thought it natural to devote an article to it.

So, a butt wink happens when, at the bottom of your squat position, your pelvis tucks rotates backward (otherwise known as a “posterior pelvic tilt”) and the lower back rounds. This motion looks like a slight ‘wink’, hence the name.

How to Avoid Butt Winking

When the pelvis tucks under and the spine rounds, it can put undue pressure on the lumbar discs. This is especially risky when squatting with weights, as it can exacerbate the stress on the spine.

To avoid a butt wink, it’s important to maintain a neutral spine throughout the squat and to work on flexibility and strength in the hips, glutes, and hamstrings. Adjusting the stance width or foot angle during squats can also help in maintaining proper form.

A visual representation would likely work better than our attempt at describing what to do, so without further ado, here’s today’s video:

How was the video? If you’ve discovered any great videos yourself that you’d like to share with fellow 10almonds readers, then please do email them to us!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails: