5 Ways To Make Your Smoothie Blood Sugar Friendly (Avoid the Spike!)

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

At 10almonds, we are often saying “eat whole fruit; don’t drink your calories”. Whole fruit is great for blood sugars; fruit juices and many smoothies on the other hand, not so much. Especially juices, being near-completely or perhaps even completely stripped of fiber, but even smoothies have had a lot of the fiber broken down and are still a liquid, meaning they are very quickly and easily digestible, and thus their sugars (whatever carbs are in there) can just zip straight into your veins.

However, there are ways to mitigate this…

Slow it down

The theme here is “give the digestive process something else to do”; some things are more quickly and easily digestible than others, and if it’s working on breaking down some of the slower things, it’s not waving sugars straight on through; they have to wait their turn.

To that end, recommendations include:

- Full-fat Greek yogurt which provides both protein and fat, helping to slow down the absorption of sugar. Always choose unsweetened versions to avoid added sugars, though!

- Coconut milk (canned) which is low in sugar and carbs, high in fat. This helps reduce blood sugar spikes, as she found through personal experimentation too.

- Avocado which is rich in healthy fats that help stabilize blood sugar. As a bonus, it blends well into smoothies without affecting the taste much.

- Coconut oil which contains medium-chain triglycerides (MCTs) that are quickly absorbed for energy without involving glucose, promoting fat-burning and reducing blood sugar spikes.

- Collagen powder which is a protein that helps lower blood sugar spikes while also supporting muscle growth, skin, and joints.

For more on all of these, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like to read:

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Recommended

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Is Air-Fried Food Really Healthier?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Air-frying has a reputation for being healthy—and it generally is, provided it’s used carefully:

Just one thing to watch out for

An air-fryer is basically a small convection oven that uses circulating air rather than immersion in oil to cook food. The smallness of an air-fryer is a feature not a bug—if you get an air-fryer over a certain size, then congratulations, you just have a convection oven. The small size it what helps it to cook so efficiently. This is one reason that they’re not really used in industrial settings.

The documentary-makers from this video had their food (chicken, fish, and fries) lab-tested (for fat, cholesterol, and acrylamide), and found:

- Air-frying significantly reduced saturated fat (38–53%) and trans fats (up to 55%) in some foods.

- Cholesterol reduction varied depending on the food type.

- Acrylamide levels in air-fried potatoes were much higher due to cooking time and temperature.

About that acrylamide: acrylamide forms in starchy foods at high temperatures and may pose cancer risks (the research is as yet unclear, with conflicting evidence). Air-frying can cause higher acrylamide levels if cooking is prolonged or temperatures are too high.

Recommendations to reduce acrylamide:

- Soak potatoes before cooking.

- Use lower temperatures (e.g. 180℃/350℉) and shorter cooking times.

- Avoid over-browning food.

For more on all of this, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like to read:

Unlock Your Air-Fryer’s Potential!

Take care!

Share This Post

-

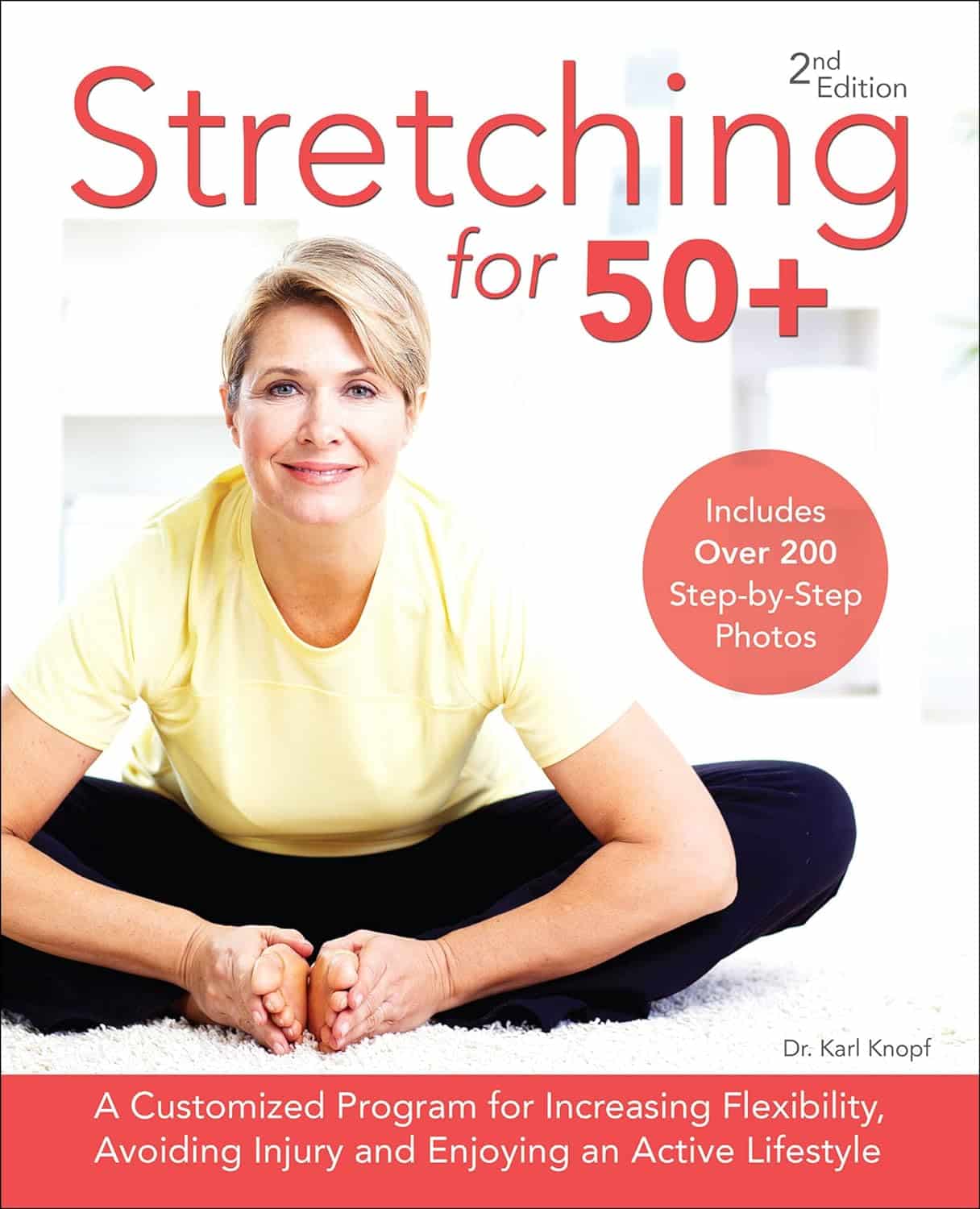

Stretching for 50+ – by Dr. Karl Knopf

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Dr. Knopf explores in this book the two-way relationship between aging and stretching (i.e., each can have a large impact on the other). Thinking about stretching in those terms is an important reframe for going into any stretching program. We’d say “after the age of 50”, but honestly, at any age. But this book is written with over-50s in mind, as the title goes.

There’s an extensive encyclopedic section on stretches per body part, which is exactly as you might expect from any book of this kind. There is also a flexibility self-assessment, so that progress can be measured easily, and so that the reader knows where might need more improvement.

Perhaps this book’s greatest strength is the section on specialized programs based on things ranging from working to improve symptoms of any chronic conditions you may have (or at least working around them, if outright improvement is not possible by stretching), to your recreational activities of importance to you—so, what kinds of flexibilities will be important to you, and also, what kinds of injury you are most likely to need to avoid.

Bottom line: if you’re 50 and would like to do more stretching and less aging, then this book can help with that.

Click here to check out Stretching for 50+, and extend your healthspan!

Share This Post

-

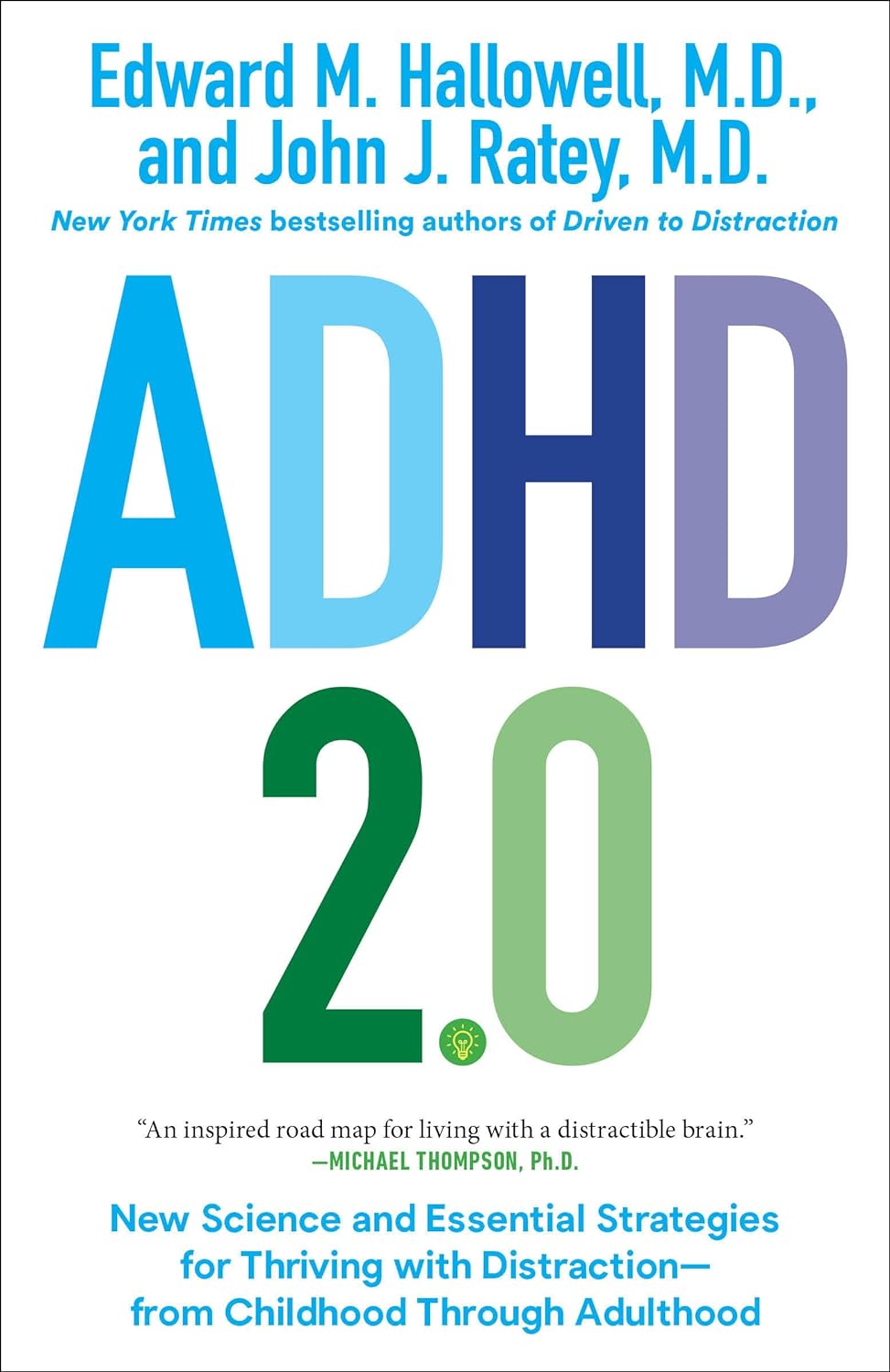

ADHD 2.0 – by Dr. Edward Hallowell & Dr. John Ratey

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

A lot of ADHD literature is based on the assumption that the reader is a 30-something parent of a child with ADHD. This book, on the other hand, addresses all ages, and includes just as readily the likelihood that the person with ADHD is the reader, and/or the reader’s partner.

The authors cover such topics as:

- ADHD mythbusting, before moving on to…

- The problems of ADHD, and the benefits that those exact same traits can bring too

- How to leverage those traits to get fewer of the problems and more of the benefits

- The role of diet beyond the obvious, including supplementation

- The role of specific exercises (especially HIIT, and balance exercises) in benefiting the ADHD brain

- The role of medications—and arguments for and gainst such

The writing style is… Thematic, let’s say. The authors have ADHD and it shows. So, expect comprehensive deep-dives from whenever their hyperfocus mode kicked in, and expect no stones left unturned. That said, it is very readable, and well-indexed too, for ease of finding specific sub-topics.

Bottom line: if you are already very familiar with ADHD, you may not learn much, and might reasonably skip this one. However, if you’re new to the topic, this book is a great—and practical—primer.

Share This Post

Related Posts

-

Fasting, eating earlier in the day or eating fewer meals – what works best for weight loss?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Globally, one in eight people are living with obesity. This is an issue because excess fat increases the risk of type 2 diabetes, heart disease and certain cancers.

Modifying your diet is important for managing obesity and preventing weight gain. This might include reducing your calorie intake, changing your eating patterns and prioritising healthy food.

But is one formula for weight loss more likely to result in success than another? Our new research compared three weight-loss methods, to see if one delivered more weight loss than the others:

- altering calorie distribution – eating more calories earlier rather than later in the day

- eating fewer meals

- intermittent fasting.

We analysed data from 29 clinical trials involving almost 2,500 people.

We found that over 12 weeks or more, the three methods resulted in similar weight loss: 1.4–1.8kg.

So if you do want to lose weight, choose a method that works best for you and your lifestyle.

chalermphon_tiam/Shutterstock Eating earlier in the day

When our metabolism isn’t functioning properly, our body can’t respond to the hormone insulin properly. This can lead to weight gain, fatigue and can increase the risk of a number of chronic diseases such as diabetes.

Eating later in the day – with a heavy dinner and late-night snacking – seems to lead to worse metabolic function. This means the body becomes less efficient at converting food into energy, managing blood sugar and regulating fat storage.

In contrast, consuming calories earlier in the day appears to improve metabolic function.

However, this might not be the case for everyone. Some people naturally have an evening “chronotype”, meaning they wake up and stay up later.

People with this chronotype appear to have less success losing weight, no matter the method. This is due to a combination of factors including genes, an increased likelihood to have a poorer diet overall and higher levels of hunger hormones.

Eating fewer meals

Skipping breakfast is common, but does it hinder weight loss? Or is a larger breakfast and smaller dinner ideal?

While frequent meals may reduce disease risk, recent studies suggest that compared to eating one to two meals a day, eating six times a day might increase weight loss success.

However, this doesn’t reflect the broader research, which tends to show consuming fewer meals can lead to greater weight loss. Our research suggests three meals a day is better than six. The easiest way to do this is by cutting out snacks and keeping breakfast, lunch and dinner.

Most studies compare three versus six meals, with limited evidence on whether two meals is better than three.

However, front-loading your calories (consuming most of your calories between breakfast and lunch) appears to be better for weight loss and may also help reduce hunger across the day. But more studies with a longer duration are needed.

Fasting, or time-restricted eating

Many of us eat over a period of more than 14 hours a day.

Eating late at night can throw off your body’s natural rhythm and alter how your organs function. Over time, this can increase your risk of type 2 diabetes and other chronic diseases, particularly among shift workers.

Time-restricted eating, a form of intermittent fasting, means eating all your calories within a six- to ten-hour window during the day when you’re most active. It’s not about changing what or how much you eat, but when you eat it.

Some people limit their calories to a six hour window, while others opt for ten hours. Shutterstock/NIKS ADS Animal studies suggest time-restricted eating can lead to weight loss and improved metabolism. But the evidence in humans is still limited, especially about the long-term benefits.

It’s also unclear if the benefits of time-restricted eating are due to the timing itself or because people are eating less overall. When we looked at studies where participants ate freely (with no intentional calorie limits) but followed an eight-hour daily eating window, they naturally consumed about 200 fewer calories per day.

What will work for you?

In the past, clinicians have thought about weight loss and avoiding weight gain as a simile equation of calories in and out. But factors such as how we distribute our calories across the day, how often we eat and whether we eat late at night may also impact our metabolism, weight and health.

There are no easy ways to lose weight. So choose a method, or combination of methods, that suits you best. You might consider

- aiming to eat in an eight-hour window

- consuming your calories earlier, by focusing on breakfast and lunch

- opting for three meals a day, instead of six.

The average adult gains 0.4 to 0.7 kg per year. Improving the quality of your diet is important to prevent this weight gain and the strategies above might also help.

Finally, there’s still a lot we don’t know about these eating patterns. Many existing studies are short-term, with small sample sizes and varied methods, making it hard to make direct comparisons.

More research is underway, including well-controlled trials with larger samples, diverse populations and consistent methods. So hopefully future research will help us better understand how altering our eating patterns can result in better health.

Hayley O’Neill, Assistant Professor, Faculty of Health Sciences and Medicine, Bond University and Loai Albarqouni, Assistant Professor | NHMRC Emerging Leadership Fellow, Bond University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

What’s The Difference Between Minoxidil For Men vs For Women?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

It’s Q&A Day at 10almonds!

Have a question or a request? We love to hear from you!

In cases where we’ve already covered something, we might link to what we wrote before, but will always be happy to revisit any of our topics again in the future too—there’s always more to say!

As ever: if the question/request can be answered briefly, we’ll do it here in our Q&A Thursday edition. If not, we’ll make a main feature of it shortly afterwards!

So, no question/request too big or small 😎

❝I’m confused, does minoxidil work the same for women and for men? The label on the minoxidil I was looking at says it is only for men❞

Great question!

Simple answer: yes, it works (or not, as the case may be for some people, more on that later) exactly the same for men and women.

You may be wondering: what, then, is the difference between minoxidil for men and minoxidil for women?

And the answer is: the packaging/marketing. That’s literally it.

It’s like with razors, there are razors marketed to men and razors marketed to women, and both come with advertising/marketing promising to be enhance your masculine/feminine appearance (as applicable), but at the end of the day, in both cases it’s just sharp steel blades that cut through hairs as closely as possible to the skin. The sharp steel neither knows nor cares about your gender.

When it comes to minoxidil, in both cases the active ingredient is indeed minoxidil, usually at 2% or 5% strength (though other options exist, and all these get marketed to men and women), and in both cases it works in the same ways, by:

- dilating the blood vessels that feed the hair follicles and thus allowing them to perform better

- kicking the follicles into anagen (growth phase) and keeping them there for longer

Note: this is why we mentioned that it won’t work for all people, and it’s because (regardless of sex/gender), it cannot do those things for your hair follicles if you do not have hair follicles to treat. In the case of someone who has had hair loss for a long time, sometimes there will not be enough living follicles remaining to do anything useful with. As a general rule of thumb, provided you have some hairs there (even if they are little downy baby hairs), they can usually be coaxed back to full life.

In both cases, it’s for treating “pattern hair loss”, the pattern being “male pattern” or “female pattern”, respectively, but in both cases it’s androgenetic alopecia, and in both cases it’s caused by the corresponding genetic factors and hormone-mediated gene expression (the physical pattern therefore is usually a little different for men and women; that’s because of the “hormone-mediated gene expression”, or to put it into lay terms “the hormones tell the body which genes to turn on and off”.

Fun fact: it’s the same resultant phenotype as for PCOS, though usually occurring at different stages in life; PCOS earlier and AGA later—sometimes people (including people with both ovaries and hair) can get one without the other, though, as there may be other considerations going on besides the genetic and hormonal.

Limitation: if the hair loss is for reasons other than androgenetic alopecia, it’s unlikely to work. In fact, it is usually flat-out stated that it won’t work, but since one of the common listed side effects of minoxidil is “hair growth in other places”, it seems fair to say that the scalp is not really the only place it can cause hair to grow.

Want to know more?

You can read about the science of various pharmaceutical options (including minoxidil) here:

Hair-Loss Remedies, By Science ← this also goes more into the pros and cons of minoxidil than we have today, so if you’re considering minoxidil, you might want to read this first, to make the most informed decision.

And if you want to be a bit less pharmaceutical about it:

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

When Your Brain’s “Get-Up-And-Go” Has Got Up And Gone…

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Sometimes, there are days when the body feels heavy, the brain feels sluggish, and even the smallest tasks feel Herculean.

When these days stack up, this is usually a sign of depression, and needs attention. Unfortunately, when one is in such a state, taking action about it is almost impossible.

Almost, but not quite, as we wrote about previously:

The Mental Health First-Aid You’ll Hopefully Never Need ← this is about as close to true mental health bootstrapping as actually works

Today though, we’re going to assume it’s just an off-day or such. So, what to do about it?

Try turning it off and on again

Sometimes, a reboot is all that’s needed, and if napping is an option, it’s worth considering. However, if you don’t do it right, you can end up groggy and worse off than before, so do check out:

How To Be An Expert Nap-Artist (No More “Sleep Hangovers”!)

If your exhaustion is nevertheless accompanied by stresses that are keeping you from resting, then there’s another “turn it off and on again” process for that:

Fuel in the tank

Our brain is an energy-intensive organ, and cannot run on empty for long. Thus, lacking energy can sometimes simply be a matter of needing to supply some energy. Simple, no? Except, a lot of energy-giving foods can cause a paradoxical slump in energy, so here’s how to avoid that:

Eating For Energy (In Ways That Actually Work)

There are occasions when exhausted, when preparing food seems like too much work. If you’re not in a position to have someone else do it for you, how can you get “most for least” in terms of nutrition for effort?

Many of the above-linked items can help (a bowl of nuts and/or dried fruit is probably not going to break the energy-bank, for instance), but beyond that, there are other considerations too:

How To Eat To Beat Chronic Fatigue (While Chronically Fatigued) ← as the title tells, this is about chronic fatigue, but the advice therein definitely goes for acute fatigue also.

The lights aren’t on

Sometimes it may be that your body is actually fine, but your brain is working in a clunky fashion at best. Assuming there is no more drastic underlying cause for this, a lack of motivation is often as simple as a lack of appropriate dopamine response. When that’s the case…

Lacking Motivation? Science Has The Answer

If, instead, the issue is more serotonin-based than dopamine based, then green places with blue skies are ideal. Depending on geography and season, those things may be in short supply, but the brain is easily tricked with artificial plants and artificial sunlight. Is it as good as a walk in the park on a pleasant summer morning? Probably not, but it’s many times better than nothing, so get those juices flowing:

Neurotransmitter Cheatsheet ← four for the price of one, here!

Schedule time for rest, or your body/brain will schedule it for you

There’s a saying in the field of engineering that “if you don’t schedule time for maintenance, your equipment will schedule it for you”, and the same is true of our body/brain. If you’re struggling to get good quantity, here’s how to at least get good quality:

How To Rest More Efficiently (Yes, Really)

And, importantly,

7 Kinds Of Rest When Sleep Is Not Enough

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails: