Fast-Pickled Cucumbers

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Pickled vegetables are great for the gut, and homemade is invariably better than store-bought. But if you don’t have pickling jars big enough for cucumbers, and don’t want to wait a couple of weeks for the results, here’s a great way to do it quickly and easily.

You will need

- 1 large cucumber, sliced

- 2 tbsp apple cider vinegar

- 1½ tbsp salt (do not omit or substitute)

- 3 cloves garlic, whole, peeled

- 3 large sprigs fresh dill

- 2 tsp whole black peppercorns

- ½ tsp crushed red pepper flakes

- 1 bay leaf

Method

(we suggest you read everything at least once before doing anything)

1) Mix the vinegar and salt with 1½ cups of water in a bowl.

2) Assemble the rest of the ingredients, except the cucumber, into a quart-size glass jar with an airtight lid.

3) Add the cucumber slices into the jar.

4) Add the pickling brine that you made, leaving ½” space at the top.

5) Close the lid, and shake well.

6) Refrigerate for 2 days, after which, serve at your leisure:

Enjoy!

Want to learn more?

For those interested in some of the science of what we have going on today:

- Making Friends With Your Gut (You Can Thank Us Later)

- Our Top 5 Spices: How Much Is Enough For Benefits? ← 3/5 of these spices are in this recipe!

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Recommended

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Rapid Rise in Syphilis Hits Native Americans Hardest

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

From her base in Gallup, New Mexico, Melissa Wyaco supervises about two dozen public health nurses who crisscross the sprawling Navajo Nation searching for patients who have tested positive for or been exposed to a disease once nearly eradicated in the U.S.: syphilis.

Infection rates in this region of the Southwest — the 27,000-square-mile reservation encompasses parts of Arizona, New Mexico, and Utah — are among the nation’s highest. And they’re far worse than anything Wyaco, who is from Zuni Pueblo (about 40 miles south of Gallup) and is the nurse consultant for the Navajo Area Indian Health Service, has seen in her 30-year nursing career.

Syphilis infections nationwide have climbed rapidly in recent years, reaching a 70-year high in 2022, according to the most recent data from the Centers for Disease Control and Prevention. That rise comes amid a shortage of penicillin, the most effective treatment. Simultaneously, congenital syphilis — syphilis passed from a pregnant person to a baby — has similarly spun out of control. Untreated, congenital syphilis can cause bone deformities, severe anemia, jaundice, meningitis, and even death. In 2022, the CDC recorded 231 stillbirths and 51 infant deaths caused by syphilis, out of 3,761 congenital syphilis cases reported that year.

And while infections have risen across the U.S., no demographic has been hit harder than Native Americans. The CDC data released in January shows that the rate of congenital syphilis among American Indians and Alaska Natives was triple the rate for African Americans and nearly 12 times the rate for white babies in 2022.

“This is a disease we thought we were going to eradicate not that long ago, because we have a treatment that works really well,” said Meghan Curry O’Connell, a member of the Cherokee Nation and chief public health officer at the Great Plains Tribal Leaders’ Health Board, who is based in South Dakota.

Instead, the rate of congenital syphilis infections among Native Americans (644.7 cases per 100,000 people in 2022) is now comparable to the rate for the entire U.S. population in 1941 (651.1) — before doctors began using penicillin to cure syphilis. (The rate fell to 6.6 nationally in 1983.)

O’Connell said that’s why the Great Plains Tribal Leaders’ Health Board and tribal leaders from North Dakota, South Dakota, Nebraska, and Iowa have asked federal Health and Human Services Secretary Xavier Becerra to declare a public health emergency in their states. A declaration would expand staffing, funding, and access to contact tracing data across their region.

“Syphilis is deadly to babies. It’s highly infectious, and it causes very severe outcomes,” O’Connell said. “We need to have people doing boots-on-the-ground work” right now.

In 2022, New Mexico reported the highest rate of congenital syphilis among states. Primary and secondary syphilis infections, which are not passed to infants, were highest in South Dakota, which had the second-highest rate of congenital syphilis in 2022. In 2021, the most recent year for which demographic data is available, South Dakota had the second-worst rate nationwide (after the District of Columbia) — and numbers were highest among the state’s large Native population.

In an October news release, the New Mexico Department of Health noted that the state had “reported a 660% increase in cases of congenital syphilis over the past five years.” A year earlier, in 2017, New Mexico reported only one case — but by 2020, that number had risen to 43, then to 76 in 2022.

Starting in 2020, the covid-19 pandemic made things worse. “Public health across the country got almost 95% diverted to doing covid care,” said Jonathan Iralu, the Indian Health Service chief clinical consultant for infectious diseases, who is based at the Gallup Indian Medical Center. “This was a really hard-hit area.”

At one point early in the pandemic, the Navajo Nation reported the highest covid rate in the U.S. Iralu suspects patients with syphilis symptoms may have avoided seeing a doctor for fear of catching covid. That said, he doesn’t think it’s fair to blame the pandemic for the high rates of syphilis, or the high rates of women passing infections to their babies during pregnancy, that continue four years later.

Native Americans are more likely to live in rural areas, far from hospital obstetric units, than any other racial or ethnic group. As a result, many do not receive prenatal care until later in pregnancy, if at all. That often means providers cannot test and treat patients for syphilis before delivery.

In New Mexico, 23% of patients did not receive prenatal care until the fifth month of pregnancy or later, or received fewer than half the appropriate number of visits for the infant’s gestational age in 2023 (the national average is less than 16%).

Inadequate prenatal care is especially risky for Native Americans, who have a greater chance than other ethnic groups of passing on a syphilis infection if they become pregnant. That’s because, among Native communities, syphilis infections are just as common in women as in men. In every other ethnic group, men are at least twice as likely to contract syphilis, largely because men who have sex with men are more susceptible to infection. O’Connell said it’s not clear why women in Native communities are disproportionately affected by syphilis.

“The Navajo Nation is a maternal health desert,” said Amanda Singer, a Diné (Navajo) doula and lactation counselor in Arizona who is also executive director of the Navajo Breastfeeding Coalition/Diné Doula Collective. On some parts of the reservation, patients have to drive more than 100 miles to reach obstetric services. “There’s a really high number of pregnant women who don’t get prenatal care throughout the whole pregnancy.”

She said that’s due not only to a lack of services but also to a mistrust of health care providers who don’t understand Native culture. Some also worry that providers might report patients who use illicit substances during their pregnancies to the police or child welfare. But it’s also because of a shrinking network of facilities: Two of the Navajo area’s labor and delivery wards have closed in the past decade. According to a recent report, more than half of U.S. rural hospitals no longer offer labor and delivery services.

Singer and the other doulas in her network believe New Mexico and Arizona could combat the syphilis epidemic by expanding access to prenatal care in rural Indigenous communities. Singer imagines a system in which midwives, doulas, and lactation counselors are able to travel to families and offer prenatal care “in their own home.”

O’Connell added that data-sharing arrangements between tribes and state, federal, and IHS offices vary widely across the country, but have posed an additional challenge to tackling the epidemic in some Native communities, including her own. Her Tribal Epidemiology Center is fighting to access South Dakota’s state data.

In the Navajo Nation and surrounding area, Iralu said, IHS infectious disease doctors meet with tribal officials every month, and he recommends that all IHS service areas have regular meetings of state, tribal, and IHS providers and public health nurses to ensure every pregnant person in those areas has been tested and treated.

IHS now recommends all patients be tested for syphilis yearly, and tests pregnant patients three times. It also expanded rapid and express testing and started offering DoxyPEP, an antibiotic that transgender women and men who have sex with men can take up to 72 hours after sex and that has been shown to reduce syphilis transmission by 87%. But perhaps the most significant change IHS has made is offering testing and treatment in the field.

Today, the public health nurses Wyaco supervises can test and treat patients for syphilis at home — something she couldn’t do when she was one of them just three years ago.

“Why not bring the penicillin to the patient instead of trying to drag the patient in to the penicillin?” said Iralu.

It’s not a tactic IHS uses for every patient, but it’s been effective in treating those who might pass an infection on to a partner or baby.

Iralu expects to see an expansion in street medicine in urban areas and van outreach in rural areas, in coming years, bringing more testing to communities — as well as an effort to put tests in patients’ hands through vending machines and the mail.

“This is a radical departure from our past,” he said. “But I think that’s the wave of the future.”

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

Share This Post

-

LGBTQ+ People Relive Old Traumas as They Age on Their Own

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Bill Hall, 71, has been fighting for his life for 38 years. These days, he’s feeling worn out.

Hall contracted HIV, the virus that can cause AIDS, in 1986. Since then, he’s battled depression, heart disease, diabetes, non-Hodgkin lymphoma, kidney cancer, and prostate cancer. This past year, Hall has been hospitalized five times with dangerous infections and life-threatening internal bleeding.

But that’s only part of what Hall, a gay man, has dealt with. Hall was born into the Tlingit tribe in a small fishing village in Alaska. He was separated from his family at age 9 and sent to a government boarding school. There, he told me, he endured years of bullying and sexual abuse that “killed my spirit.”

Because of the trauma, Hall said, he’s never been able to form an intimate relationship. He contracted HIV from anonymous sex at bath houses he used to visit. He lives alone in Seattle and has been on his own throughout his adult life.

“It’s really difficult to maintain a positive attitude when you’re going through so much,” said Hall, who works with Native American community organizations. “You become mentally exhausted.”

It’s a sentiment shared by many older LGBTQ+ adults — most of whom, like Hall, are trying to manage on their own.

Of the 3 million Americans over age 50 who identify as gay, bisexual, or transgender, about twice as many are single and living alone when compared with their heterosexual counterparts, according to the National Resource Center on LGBTQ+ Aging.

This slice of the older population is expanding rapidly. By 2030, the number of LGBTQ+ seniors is expected to double. Many won’t have partners and most won’t have children or grandchildren to help care for them, AARP research indicates.

They face a daunting array of problems, including higher-than-usual rates of anxiety and depression, chronic stress, disability, and chronic illnesses such as heart disease, according to numerous research studies. High rates of smoking, alcohol use, and drug use — all ways people try to cope with stress — contribute to poor health.

Keep in mind, this generation grew up at a time when every state outlawed same-sex relations and when the American Psychiatric Association identified homosexuality as a psychiatric disorder. Many were rejected by their families and their churches when they came out. Then, they endured the horrifying impact of the AIDS crisis.

“Dozens of people were dying every day,” Hall said. “Your life becomes going to support groups, going to visit friends in the hospital, going to funerals.”

It’s no wonder that LGBTQ+ seniors often withdraw socially and experience isolation more commonly than other older adults. “There was too much grief, too much anger, too much trauma — too many people were dying,” said Vincent Crisostomo, director of aging services for the San Francisco AIDS Foundation. “It was just too much to bear.”

In an AARP survey of 2,200 LGBTQ+ adults 45 or older this year, 48% said they felt isolated from others and 45% reported lacking companionship. Almost 80% reported being concerned about having adequate social support as they grow older.

Embracing aging isn’t easy for anyone, but it can be especially difficult for LGBTQ+ seniors who are long-term HIV survivors like Hall.

Related Links

- Americans With HIV Are Living Longer. Federal Spending Isn’t Keeping Up. Jun 17, 2024

- ‘Stonewall Generation’ Confronts Old Age, Sickness — And Discrimination May 22, 2019

- Staying Out Of The Closet In Old Age Oct 17, 2016

Of 1.2 million people living with HIV in the United States, about half are over age 50. By 2030, that’s estimated to rise to 70%.

Christopher Christensen, 72, of Palm Springs, California, has been HIV-positive since May 1981 and is deeply involved with local organizations serving HIV survivors. “A lot of people living with HIV never thought they’d grow old — or planned for it — because they thought they would die quickly,” Christensen said.

Jeff Berry is executive director of the Reunion Project, an alliance of long-term HIV survivors. “Here people are who survived the AIDS epidemic, and all these years later their health issues are getting worse and they’re losing their peers again,” Berry said. “And it’s triggering this post-traumatic stress that’s been underlying for many, many years. Yes, it’s part of getting older. But it’s very, very hard.”

Being on their own, without people who understand how the past is informing current challenges, can magnify those difficulties.

“Not having access to supports and services that are both LGBTQ-friendly and age-friendly is a real hardship for many,” said Christina DaCosta, chief experience officer at SAGE, the nation’s largest and oldest organization for older LGBTQ+ adults.

Diedra Nottingham, a 74-year-old gay woman, lives alone in a one-bedroom apartment in Stonewall House, an LGBTQ+-friendly elder housing complex in New York City. “I just don’t trust people,“ she said. “And I don’t want to get hurt, either, by the way people attack gay people.”

When I first spoke to Nottingham in 2022, she described a post-traumatic-stress-type reaction to so many people dying of covid-19 and the fear of becoming infected. This was a common reaction among older people who are gay, bisexual, or transgender and who bear psychological scars from the AIDS epidemic.

Nottingham was kicked out of her house by her mother at age 14 and spent the next four years on the streets. The only sibling she talks with regularly lives across the country in Seattle. Four partners whom she’d remained close with died in short order in 1999 and 2000, and her last partner passed away in 2003.

When I talked to her in September, Nottingham said she was benefiting from weekly therapy sessions and time spent with a volunteer “friendly visitor” arranged by SAGE. Yet she acknowledged: “I don’t like being by myself all the time the way I am. I’m lonely.”

Donald Bell, a 74-year-old gay Black man who is co-chair of the Illinois Commission on LGBTQ Aging, lives alone in a studio apartment in subsidized LGBTQ+-friendly senior housing in Chicago. He spent 30 years caring for two elderly parents who had serious health issues, while he was also a single father, raising two sons he adopted from a niece.

Bell has very little money, he said, because he left work as a higher-education administrator to care for his parents. “The cost of health care bankrupted us,” he said. (According to SAGE, one-third of older LGBTQ+ adults live at or below 200% of the federal poverty level.) He has hypertension, diabetes, heart disease, and nerve damage in his feet. These days, he walks with a cane.

To his great regret, Bell told me, he’s never had a long-term relationship. But he has several good friends in his building and in the city.

“Of course I experience loneliness,” Bell said when we spoke in June. “But the fact that I am a Black man who has lived to 74, that I have not been destroyed, that I have the sanctity of my own life and my own person is a victory and something for which I am grateful.”

Now he wants to be a model to younger gay men and accept aging rather than feeling stuck in the past. “My past is over,” Bell said, “and I must move on.”

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

Share This Post

-

New Year, New Health Habits?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

It’s that time of the year, and many of us hope to make this our healthiest year yet—or at least significantly improve it in some particular area that’s important to us! So, what news from the health world?

The rise of GLP-1 agonists continues

GLP-1 agonists have surged in popularity in the past year, and it looks like that trend is set to continue in the new one. The title of the below-linked pop-science article is slightly misleading, it’s not “almost three quarters of UK women”, but rather, “72% of the women using the digital weight loss platform Juniper”, which means the sample is confined to people interested in weight loss. Still, of those interested in weight loss, 72% is a lot, and the sample size was over 1000:

Read in full: New Year, new approach to weight loss: Almost three quarters of UK women are considering using GLP-1s in 2025

Related: 5 ways to naturally boost the “Ozempic Effect” ← these natural methods “hack” the same metabolic pathways as GLP-1 agonists do (it has to do with incretin levels), causing similar results

The lesser of two evils

Smoking is terrible, for everything. Vaping is… Not great, honestly, but as the below-discussed study shows, at the very least it results in much less severe respiratory symptoms than actual smoking. For many, vaping is a halfway-house to actually quitting; for some, it’s just harm reduction, and that too can be worthwhile.

We imagine that probably very few 10almonds readers smoke cigarettes, but we know quite a few use cannabis, which is discussed also:

Read in full: Switching to e-cigarettes may ease respiratory symptoms, offering hope for smokers

Related: Vaping: A Lot Of Hot Air? ← we look at the pros, cons, and popular beliefs that were true a little while ago but now they’re largely not (because of regulatory changes re what’s allowed in vapes)

Sometimes, more is more

The below-linked pop-science article has a potentially confusingly-worded title that makes it sound like increased exercise duration results in decreasing marginal returns (i.e., after a certain point, you’re getting very limited extra benefits), but in fact the study says the opposite.

Rather, increased moderate exercise (so, walking etc) results in a commensurately decreasing weight and a decreasing waistline.

In short: walk more, lose more (pounds and inches). The study examined those who moved their bodies for 150–300 minutes per week:

Read in full: Increased exercise duration linked to decreasing results in weight and waistline

Related: The Doctor Who Wants Us To Exercise Less, & Move More

Take care!

Share This Post

Related Posts

-

Climate Change Threatens the Mental Well-Being of Youths. Here’s How To Help Them Cope.

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

We’ve all read the stories and seen the images: The life-threatening heat waves. The wildfires of unprecedented ferocity. The record-breaking storms washing away entire neighborhoods. The melting glaciers, the rising sea levels, the coastal flooding.

As California wildfires stretch into the colder months and hurricane survivors sort through the ruins left by floodwaters, let’s talk about an underreported victim of climate change: the emotional well-being of young people.

A nascent but growing body of research shows that a large proportion of adolescents and young adults, in the United States and abroad, feel anxious and worried about the impact of an unstable climate in their lives today and in the future.

Abby Rafeek, 14, is disquieted by the ravages of climate change, both near her home and far away. “It’s definitely affecting my life, because it’s causing stress thinking about the future and how, if we’re not addressing the problem now as a society, our planet is going to get worse,” says Abby, a high school student who lives in Gardena, California, a city of 58,000 about 15 miles south of downtown Los Angeles.

She says wildfires are a particular worry for her. “That’s closer to where I live, so it’s a bigger problem for me personally, and it also causes a lot of damage to the surrounding areas,” she says. “And also, the air gets messed up.”

In April, Abby took a survey on climate change for kids ages 12-17 during a visit to the emergency room at Children’s Hospital of Orange County.

Rammy Assaf, a pediatric emergency physician at the hospital, adapted the survey from one developed five years ago for adults. He administered his version last year to over 800 kids ages 12-17 and their caregivers. He says initial results show climate change is a serious cause of concern for the emotional security and well-being of young people.

Assaf has followed up with the kids to ask more open-ended questions, including whether they believe climate change will be solved in their lifetimes; how they feel when they read about extreme climate events; what they think about the future of the planet; and with whom they are able to discuss their concerns.

“When asked about their outlook for the future, the first words they will use are helpless, powerless, hopeless,” Assaf says. “These are very strong emotions.”

Assaf says he would like to see questions about climate change included in mental health screenings at pediatricians’ offices and in other settings where children get medical care. The American Academy of Pediatrics recommends that counseling on climate change be incorporated into the clinical practice of pediatricians and into medical school curriculums, but not with specific regard to mental health screening.

Assaf says anxiety about climate change intersects with the broader mental health crisis among youth, which has been marked by a rise in depression, loneliness, and suicide over the past decade, though there are recent signs it may be improving slightly.

A 2022 Harris Poll of 1,500 U.S. teenagers found that 89% of them regularly think about the environment, “with the majority feeling more worried than hopeful.” In addition, 69% said they feared they and their families would be affected by climate change in the near future. And 82% said they expected to have to make key life decisions — including where to live and whether to have children — based on the state of the environment.

And the impact is clearly not limited to the U.S. A 2021 survey of 10,000 16- to 25-year-olds across 10 countries found “59% were very or extremely worried and 84% were at least moderately worried” about climate change.

Susan Clayton, chair of the psychology department at the College of Wooster in Ohio, says climate change anxiety may be more pronounced among younger people than adults. “Older adults didn’t grow up being as aware of climate change or thinking about it very much, so there’s still a barrier to get over to accept it’s a real thing,” says Clayton, who co-created the adult climate change survey that Assaf adapted for younger people.

By contrast, “adolescents grew up with it as a real thing,” Clayton says. “Knowing you have the bulk of your life ahead of you gives you a very different view of what your life will be like.” She adds that younger people in particular feel betrayed by their government, which they don’t think is taking the problem seriously enough, and “this feeling of betrayal is associated with greater anxiety about the climate.”

Abby believes climate change is not being addressed with sufficient resolve. “I think if we figure out how to live on Mars and explore the deep sea, we could definitely figure out how to live here in a healthy environment,” she says.

If you are a parent whose children show signs of climate anxiety, you can help.

Louise Chawla, professor emerita in the environmental design program at the University of Colorado-Boulder, says the most important thing is to listen in an open-ended way. “Let there be space for kids to express their emotions. Just listen to them and let them know it’s safe to express these emotions,” says Chawla, who co-founded the nonprofit Growing Up Boulder, which works with the city’s schools to encourage kids to engage civically, including to help shape their local environment.

Chawla and others recommend family activities that reinforce a commitment to the environment. They can be as simple as walking or biking and participating in cleanup or recycling efforts. Also, encourage your children to join activities and advocacy efforts sponsored by environmental, civic, or religious organizations.

Working with others can help alleviate stress and feelings of powerlessness by reassuring kids they are not alone and that they can be proactive.

Worries about climate change should be seen as a learning opportunity that might even lead some kids to their life’s path, says Vickie Mays, professor of psychology and health policy at UCLA, who teaches a class on climate change and mental health — one of eight similar courses offered recently at UC campuses.

“We should get out of this habit of ‘everything’s a mental health problem,’” Mays says, “and understand that often a challenge, a stress, a worry can be turned into advocacy, activism, or a reach for new knowledge to change the situation.”

This article was produced by KFF Health News, which publishes California Healthline, an editorially independent service of the California Health Care Foundation.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

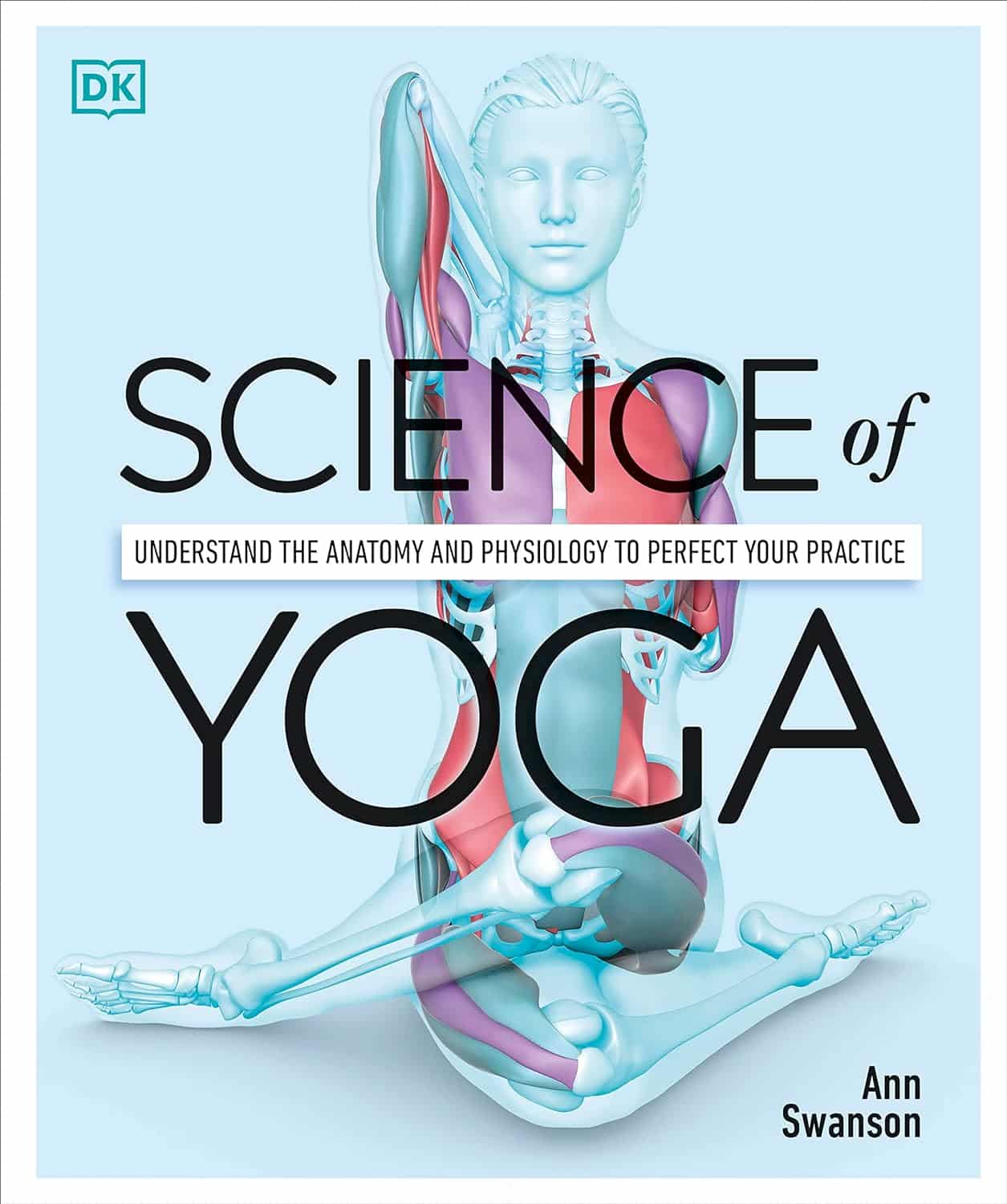

Science of Yoga – by Ann Swanson

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

There are a lot of yoga books out there to say “bend this way, hold this that way” and so forth, but few that really explain what is going on, how, and why. And understanding those things is of course key to motivation and adherence. So that’s what this book provides!

The book is divided into sections, and in the first part we have a tour of human anatomy and physiology. This may seem almost unrelated to yoga, but is valuable necessary-knowledge to get the most out of the next section:

The next few parts are given over to yoga asanas (stretches, positions, poses, call them what you will in English) and now we are given a clear idea of what it is doing: we get to understand exactly what’s being stretched, what blood flow is being increased and how, what organs are being settled into their correct place, and many other such things.

Importantly, this means we also understand why certain things are the way they are, and why they can’t be done in some other slightly different but perhaps superficially easier way.

The style of the book is like a school textbook, really, but without patronizing the reader. The illustrations, of which there are many, are simple enough to be clear while being detailed enough to be informative.

Bottom line: if you’re ever doing yoga at home and wondering if you should cut a certain corner, this is the book that will tell you why you shouldn’t.

Click here to check out Science of Yoga, and optimize your practice!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Breadfruit vs Custard Apple – Which is Healthier?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Our Verdict

When comparing breadfruit to custard apple, we picked the breadfruit.

Why?

Today in “fruits pretending to be less healthy things than they are”, both are great, but one of these fruits just edges out the other in all categories. This is quite simple today:

In terms of macros, being fruits they’re both fairly high in carbs and fiber, however the carbs are close to equal and breadfruit has nearly 2x the fiber.

This also means that breadfruit has the lower glycemic index, but they’re both medium-low GI foods with a low insulin index.

When it comes to vitamins, breadfruit has more of vitamins B1, B3, B5, and C, while custard apple has more of vitamins A, B2, and B6. So, a 4:3 win for breadfruit.

In the category of minerals, breadfruit has more copper, magnesium, phosphorus, potassium, and zinc, while custard apple has more calcium and iron.

In short, enjoy both, but if you’re going just for one, breadfruit is the healthiest.

Want to learn more?

You might like to read:

Which Sugars Are Healthier, And Which Are Just The Same?

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails: