Coconut Milk vs Soy Milk – Which is Healthier?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Our Verdict

When comparing coconut milk to soy milk, we picked the soy.

Why?

First, because there are many kinds of both, let’s be clear which ones we’re comparing. For both, we picked the healthiest options commonly available, which were:

- Soy milk, unsweetened, fortified

- Coconut milk, raw (liquid expressed from grated meat and water)

Macronutrients are our first consideration; coconut milk has about 3x the carbs and about 14x the fat. Now, the fats are famously healthy medium-chain triglycerides (MCTs), but still, one cup of coconut milk contains about 2.5x the recommended daily amount of saturated fat, so it’s wise to go easy on that. Coconut milk also has about 4x the fiber, but still, because the saturated fat difference, we’re calling this one a win for soy milk.

In the category of vitamins, the fortified soy milk wins. In case you’re curious: milk in general (animal or plant) is generally fortified with vitamin D (in N. America, anyway; other places may vary), and vitamin B12. In this case, the soy milk has those, plus some natural vitamins, meaning it has more of vitamins A, B1, B2, B6, and D, while coconut milk has more of vitamins B3, B5, and C. A fair win for soy milk.

When it comes to minerals, the only fortification for the soy milk is calcium, of which it has more than 7x what coconut milk has. The coconut milk, however, has more copper, iron, magnesium, phosphorus, and potassium. An easy win for coconut milk.

Adding up the sections gives us a win for soy milk—but if consumed in moderation as part of a diet otherwise low in saturated fat, a case could be made for the coconut.

The real take-away here today is not this specific head-to-head but rather: milks (animal or plant) vary a lot, have a lot of different fortifications and/or additives, and yes that goes even for brands (cow milk brands do this a lot) who don’t advertise their additives because their branding is going for a “natural” look. So, read labels, and make informed decisions about which additives you do or don’t want.

Enjoy!

Want to learn more?

You might like to read:

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Recommended

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

The Spectrum of Hope – by Dr. Gayatri Devi

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

We’ve written before about Dr. Devi’s work (See: “Alzheimer’s: The Bad News And The Good“) but she has plenty more to say than we could fit in an article.

The book is written for patients, family/carers, and clinicians—without getting deep into the science, which it is assumed clinicians will know. the general style of the book is pop-science, and it’s more about addressing the misconceptions around Alzheimer’s, rather than focusing on neurological features such as beta amyloid plaques and tau proteins and the like.

Dr. Devi explains a lot about the experience of Alzheimer’s—what to expect, or rather, what to know about in advance. Because, as she explains, there are a lot of different manifestations of Alzheimer’s that are all lumped under the same umbrella.

This means that a person could have negligible memory but perfect language and reasoning skills, or the other way around, or some other combination of symptoms showing up or not.

Which means that any plan for managing one’s Alzheimer’s needs to be adaptable and personalized, which is something Dr. Devi talks us through, too.

Bottom line: if you are a loved one has Alzheimer’s, or you just like to be prepared, this is a great book to prepare anybody for just that.

Click here to check out The Spectrum of Hope, and hold onto that hope!

Share This Post

-

Hello Sleep – by Dr. Jade Wu

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

We’ve reviewed other sleep books before, so what makes this one stand out?

Mostly, it’s because this one takes quite a different approach.

While still giving a nod to the sensible advice you’ve already read in many places (including here at 10almonds), Dr. Wu looks to help the reader avoid falling into the trap (or: help the reader get out of the trap, if already there) of focussing so much on getting better sleep that it becomes an all-consuming stressor that takes up much of the day thinking about it, and guess what, much of the night too, because you’re busy working out how sleep-deprived you’re going to be tomorrow.

Instead, Dr. Wu recommends to work with your body rather than against it, worry less, and ultimately sleep better. Of course, the “how” of this is what makes most of the book.

She does also give chapters on things that may be different for you, based on such things as hormones, age, or medical conditions.

The writing style is pop-science but with frequent references to scientific papers as appropriate, making good science very accessible.

Bottom line: if you’ve tried everything else and/but good sleep still eludes you, this book will help you to end the battle and make friends with your sleep (a metaphor the author uses throughout the book, by the way).

Click here to check out Hello Sleep, and indeed get better sleep!

Share This Post

-

What’s the difference between medical abortion and surgical abortion?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

In Australia, around one in four people who are able to get pregnant will have a medical or surgical abortion in their lifetime.

Both options are safe, legal and effective. The choice between them usually comes down to personal preference and availability.

So, what’s the difference?

PeopleImages.com – Yuri A/Shutterstock What is a medical abortion?

A medical abortion involves taking two types of tablets, sold together in Australia as MS2Step.

The first tablet, mifepristone, stops the hormone progesterone, which is needed for pregnancy. This causes the lining of the uterus to break down and stops the embryo from growing.

After taking mifepristone, you wait 36–48 hours before taking the second tablet, misoprostol. Misoprostol makes the cervix (the opening of the uterus) softer and starts contractions to expel the pregnancy.

It’s normal to have strong pain and heavy bleeding with clots after taking misoprostol. Pain relief including ibuprofen and paracetamol can help.

After two to six hours, the bleeding and pain usually become like a normal period, although this may last between two to six weeks.

Haemorrhage after a medical abortion is rare (occurring in fewer than 1% of abortions). But you should seek help if bleeding remains heavy (if you soak two pads per hour for two consecutive hours) or if you have have signs of infection (such as a fever, increasing abdominal pain or smelly vaginal discharge).

Do I have to go to hospital?

It is legal to have a medical abortion outside of a hospital up to nine weeks of pregnancy.

Depending on state or territory law, the medication can be prescribed by a qualified health-care provider such as a GP, nurse practitioner or endorsed midwife. These clinicians often work in GP surgeries or sexual and reproductive health clinics and they may use telehealth.

Medical abortions also occur after nine weeks of pregnancy, but these are done in hospitals and overseen by doctors alongside nurses or midwives.

Medical abortions after 20 weeks are done by taking medications to start early labour in a maternity unit. Often, medications are first given to stop the foetal heartbeat so it is not born alive. Then, other medications are given to manage pain.

These types of abortions are very rare. They may be used when an obstacle has prevented someone accessing an abortion earlier, continuing with the pregnancy is dangerous for the pregnant person’s health or if there is a serious problem with the foetus.

Medical abortions in Australia involve taking two tablets, usually around two days apart. PeopleImages.com – Yuri A/Shutterstock What is a surgical abortion?

Surgical abortions are performed in an operating unit, usually with sedation, so you will not remember the procedure. Surgical abortions are sometimes preferred over medical abortions because they are quicker. But the decision should be between you and your health-care provider.

In the first 12–14 weeks of pregnancy, a surgical abortion takes less than 15 minutes and patients are usually discharged a few hours after the procedure.

Medications may be given before surgery to soften and open the cervix and to ease pain. During the procedure, the cervix is gently stretched open and the contents of the uterus are removed with a small tube. This procedure is carried out by trained doctors with the assistance of nurses.

Surgical abortions after 12–14 weeks are more complex and are performed by specially trained doctors. Similar to medical abortions, medications may be given first to stop the foetal heartbeat.

It is normal to experience some cramping and bleeding after a surgical abortion, which can last about two weeks. However, like medical abortion, you should seek help for heavy bleeding or signs of infection.

Do I need an ultrasound?

It used to be common before an abortion to have an ultrasound scan to check how far along the pregnancy was and to make sure it was not ectopic (outside the uterus).

However, this is no longer recommended in the early stages of pregnancy (up to 14 weeks) if it delays access to abortion. If the date of the last menstrual period is known and there are no other concerning symptoms, an ultrasound scan may not be necessary.

This means people can access medical abortion much sooner, even from the first day of a missed period, without waiting for the embryo to be big enough to be seen on an ultrasound scan. This is called “very early medical abortion”.

Before and after care

Before having an abortion, a health-care provider will explain common side effects and when to seek urgent medical attention. For people who want it, many types of contraception can be started the day of abortion.

Your health-care provider will help you understand your options, including whether you want to start contraception. PowerUp/Shutterstock Even though the success rate of medical abortion is very high (over 95%) it is routine to make sure the person is no longer pregnant.

This is usually done two to three weeks after taking the first tablet mifepristone, either by a low-sensitivity urine pregnancy test (which you can do at home) or a blood test.

In the rare case a medical abortion has not worked, a surgical abortion can be done.

Sometimes after a medical or surgical abortion, tissue is left behind in the uterus. If this happens you may need another dose of misoprostol (the second tablet) or a surgical procedure to remove the tissue.

Some people may also seek support-based counselling or peer support to help them work through the emotions that might accompany having an abortion.

Understanding the differences and similarities between medical and surgical abortions can help individuals make informed decisions about their reproductive health.

It’s important to speak with an unbiased health-care provider to discuss the best option for your circumstances and to ensure you receive the necessary follow-up care and support.

Lydia Mainey, Senior Nursing Lecturer, CQUniversity Australia

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Share This Post

Related Posts

-

Anxiety Attack vs Panic Attack: Do You Know The Difference?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

The terms are sometimes used incorrectly, but have quite different meanings. Dr. Julie Smith, psychologist, explains in this short video:

Important distinctions

Anxiety attacks are not clinically recognized terms and lack a clear definition, often used to describe a build-up of anxiety before anticipated stressful events (e.g. social gatherings, medical appointments, etc, though of course what it is will vary from person to person—not everyone finds the same things stressful, or has the same kinds of anticipations around things).

Panic attacks, in contrast, are sudden surges of intense fear or discomfort that peak within minutes. They are characterized by symptoms including at least 4 of:

- palpitations

- sweating

- shortness of breath

- chest pain

- dizziness

- fear of losing control or dying

There’s a misconception that panic attacks never have identifiable triggers while anxiety attacks always do.

In reality, both can occur with or without a clear cause. Panic attacks can arise from various conditions, including trauma, OCD, or phobias, and don’t necessarily mean you have a panic disorder. They can also occur as a drug response, without any known underlying psychological condition.

You may also notice that that list of symptoms has quite a bit of overlap with the symptoms of a heart attack, which a) does not help people to calm down b) can, on the flipside, cause a heart attack to be misdiagnosed as a panic attack.

In terms of management:

- In the moment: breathing exercises, like extending your exhalation (a common example is the “7-11” method, inhaling for 7 seconds and exhaling for 11 seconds), can calm the body and reduce panic symptoms.

- More generally: to prevent panic attacks from becoming more frequent, avoid avoiding safe environments that triggered an attack, like supermarkets or social gatherings. Gradual exposure helps reduce anxiety over time, while avoidance can worsen it.

If panic attacks persist, Dr. Smith advises to seek help from a doctor or psychologist to understand their root causes and develop effective coping strategies.

For more on all of this, enjoy:

Click Here If The Embedded Video Doesn’t Load Automatically!

Want to learn more?

You might also like to read:

Take care!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

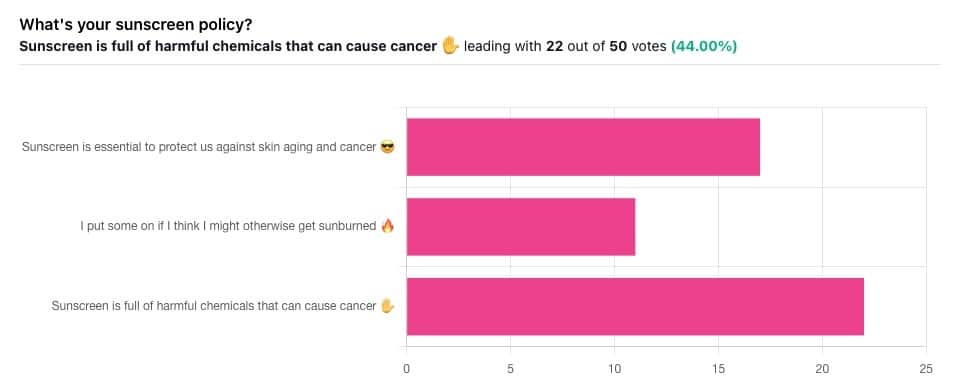

Who Screens The Sunscreens?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

We Screen The Sunscreens!

Yesterday, we asked you what your sunscreen policy was, and got a spread of answers. Apparently this one was quite polarizing!

One subscriber who voted for “Sunscreen is essential to protect us against skin aging and cancer” wrote:

❝My mom died of complications from melanoma, so we are vigilant about sun and sunscreen. We are a family of campers and hikers and gardeners—outdoors in all seasons—and we never burn❞

Our condolences with regard to your mom! Life is so precious, and when something like that happens, it tends to stick with us. We’re glad you and your family are taking care of yourselves.

Of the subscribers who voted for “I put some on if I think I might otherwise get sunburned”, about half wrote to express uncertainties:

- uncertainty about how safe it is, and

- uncertainty about how helpful it is

…so we’re going to tackle those questions in a moment. But what of those who voted for “Sunscreen is full of harmful chemicals that can cause cancer”?

Of those, only one wrote a message, which was to say one has to be very careful of what is in the formula.

Let’s take a look, then…

Sunscreen is full of harmful chemicals that can cause cancer: True or False?

False—according to current best science. Research is ongoing!

There are four main chemicals (found in most sunscreens) that people tend to worry about:

- Abobenzone

- Oxybenzone

- Octocrylene

- Ecamsule

Now, these two sound like four brands of rocket fuel, but then, dihydrogen monoxide (DHMO), which is also found in most sunscreens, sounds like a deadly toxin too. That’s water, by the way.

But what of these four chemicals? Well, as we say, research is ongoing, but we found a study that measured all four, to see how much got into the blood, and what adverse effects, if any, this caused.

We’ll skip to their conclusion:

❝In this preliminary study involving healthy volunteers, application of 4 commercially available sunscreens under maximal use conditions resulted in plasma concentrations that exceeded the threshold established by the FDA for potentially waiving some nonclinical toxicology studies for sunscreens. The systemic absorption of sunscreen ingredients supports the need for further studies to determine the clinical significance of these findings. These results do not indicate that individuals should refrain from the use of sunscreen.❞

Now, “exceeded the threshold established by the FDA for potentially waiving some nonclinical toxicology studies for sunscreens” sounds alarming, so why did they close with the words “These results do not indicate that individuals should refrain from the use of sunscreen”?

Let’s skip back up to a line from the results:

❝The most common adverse event was rash, which developed in 1 participant with each sunscreen.❞

This was most probably due to the oxybenzone, which can cause allergic skin reactions in some people.

Let us take a moment to remember the most common adverse event that occurs from not wearing sunscreen: sunburn!

You can read the full study here:

None of those ingredients have been found to be carcinogenic, even at the maximal blood plasma concentrations studied, from applications 4x/day to 75% of the body.

UVA rays, on the other hand, are absolutely very much known to cause cancer, and the effect is cumulative.

Sunscreen is essential to protect us against skin aging and cancer: True or False?

True, unequivocally, unless we live indoors and/or otherwise never go about under sunlight.

“But our ancestors—” lived under the same sun we do, and either used sunscreen or got advanced skin aging and cancer.

Sunscreen of times past ranged from mud to mineral lotions, but it’s pretty much always existed. Even non-human animals that have skin and don’t have fur or feathers, tend to take mud-baths in sunny parts of the world.

If you’d like to avoid oxybenzone and other chemicals, though, you might have your reasons. Maybe you’re allergic, or maybe you read that it’s a potential endocrine disruptor with estrogen-like and anti-androgenic properties that you don’t want.

There are other options, to include physical blockers containing zinc and titanium dioxide, which are generally recognized as safe and effective ingredients.

If you’re interested, you can even make your own sunscreen that blocks both UVA and UVB rays (UVA is what causes skin cancer; UVB is “milder” and is what causes sunburn):

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails:

-

Strawberries vs Cherries – Which is Healthier?

10almonds is reader-supported. We may, at no cost to you, receive a portion of sales if you purchase a product through a link in this article.

Our Verdict

When comparing strawberries to cherries, we picked the cherries.

Why?

Both are great, and an argument could be made for either! But here’s our rationale:

In terms of macros, as with most fruits they are both mostly water, and have similar carbs and fiber. Nominally, cherries have the lower glycemic index, so we could call this category nominally a win for cherries, but honestly, they’re both low-GI foods and nobody is getting metabolic disease from eating strawberries, so it’s fairer to consider this category a tie.

Looking at the vitamins, strawberries have more of vitamins C, B9, E, and K, while cherries have more of vitamins A, B1, B2, B3, B5, and choline. Thus, a modest win for cherries here.

When it comes to minerals, strawberries see their day: strawberries have more iron, magnesium, manganese, and phosphorus, while cherries have more calcium, copper, and potassium. By the numbers, a win for strawberries.

So far, so tied!

What swings it into cherries’ favor is cherries’ slew of specific phytochemical benefits, including cherry-specific anti-inflammatory properties, sleep-improving abilities, and post-exercise recovery boosts, as well as anti-diabetic benefits above and beyond the normal “this is a fruit” level.

In short, both are very respectable fruits, but cherries have some extra qualities that are just special.

Of course, as ever, enjoy either or both; diversity is good!

Want to learn more?

You might like to read:

Cherries’ Health Benefits Simply Pop

Enjoy!

Don’t Forget…

Did you arrive here from our newsletter? Don’t forget to return to the email to continue learning!

Learn to Age Gracefully

Join the 98k+ American women taking control of their health & aging with our 100% free (and fun!) daily emails: